How to Start Making Money Trading Digital Options Online:

A Step-by-Step Beginners Guide

Introduction

Options trading is a fantastic way to build wealth and achieve financial freedom, and it's easier than ever to get started thanks to the power of the internet. However, there's a bit of a learning curve involved. But don't worry, We've got you covered.

By the end of this guide, you will have a clear understanding of everything you need to know about digital options. This includes the basics of what digital options are and how they work, as well as the strategies and techniques you can use to maximize your profits. Whether you're a seasoned trader looking to expand your portfolio or a complete newbie just dipping your toes into the world of finance, this guide is tailored to meet your needs.

So, buckle up and get ready to learn how to start making money trading options online and develop a solid foundation for your options trading journey!

What Are The Main Benefits Of Trading Digital Options?

-

Easy to learn and trade: The simple nature of digital options trading makes it very easy for beginners to understand and start trading in a very short time compared to other traditional trading methods like margin trading in forex or stocks. With digital options, there are very few parameters to analyze; you only need to decide whether the price will go up or down.

-

Low entry barrier: The minimum deposit amount for opening an account is only $5, and the minimum amount for placing a new trade on some brokers like Deriv is only $0.35. So, you don't need thousands of dollars to begin trading options online. Plus, opening an options trading account is also simple and quick. You can open an options trading account, deposit your trading capital, and start making trades in less than ten minutes if you already understand the basics.

-

Trade anytime, even on weekends: Options trading is available 7 days a week, including the weekends, so you can make your profits on a daily basis. This is perfect for anybody who has a permanent job and can only find time to trade at nights or on weekends.

-

Realtime accessibility and freedom: You can trade and make money from any internet-connected device from any location on the planet.

-

No commissions or fees: You are not charged any fees or commissions for opening or closing digital option trades.

-

Predetermined or fixed Risk and Reward: You get no surprises with digital options trading. You know exactly what you stand to gain or lose before entering a trade, and this gives you more control over your money and risk management.

-

High reward with low risk: Your payout rate for a successful trade can reach as high as 3,900% or higher with some digital option brokers, while the risk is always maintained at 100% with all digital option brokers. That's a 39:1 profit-to-loss ratio. Meaning that if you invest $100 and your trade is successful, you would make a profit of $3,900. However, if your trade is unsuccessful, you would only lose $100. But please note that the average payout rate for most brokers is between 70% and 120% for most types of options.

-

Quick profits and turnover rate: A digital options trade can last from one second to one year. This means that trading digital options can result in quick profits in a relatively short time. It's possible to double your trading capital in fifteen minutes, and it's also possible to lose or blow your entire trading capital in fifteen minutes. That's the beauty and power of trading digital options.

-

Access to a large variety of assets: There's no lack of assets to trade with digital options. You get a variety of underlying assets that you can trade, like synthetics, currencies, commodities, stocks, crypto, and indices.

-

Thrilling and exciting: It feels really amazing to make a lot of money in a relatively short time, and that's why a lot of traders only prefer trading digital options because of their potential to give us very high returns in a very short time. But also remember that the opposite is also true. You can lose a lot of money trading digital options in a very short time. Being a trader is like riding a roller coaster; there are highs and lows. So please be careful and keep your greed and other emotions under control, because your success as an options trader mainly depends on your ability to control your emotions.

-

Free demo accounts: All brokers worth trading with will provide you with a free demo trading account. All you need to open a demo account is your email address. This will allow you to test things out before you make a decision about whether digital options trading is something you can handle or not. This is one of the greatest benefits of digital options trading.

What Are The Requirements For Trading Options?

- You must be 18 years old or older in order to open an options trading account.

- You should have access to a smartphone or computer with a reliable and fast internet connection.

- Dedicate at least thirty minutes a day to trading options.

- Make it a daily habit to strengthen your self-drive, keep an open mind, and develop a positive imagination, so you can boldly grasp opportunities that others may miss.

Understanding Digital Options Trading

What are Options?

Options are financial instruments that allow you to make predictions about whether the price of an underlying asset like a stock or currency pair will remain the same, rise, or fall within a specific time period. If you are wrong, you make a loss, and if you are right, you make a profit.

Options trading differs from traditional trading in that you don't need to buy the actual stock or own the asset you're trading. Instead, you're speculating on the asset's price movement with the aim of earning profits.

What's The Difference Between Digital Options and Binary Options?

Digital options and binary options are financial contracts that share many similarities but have some differences. Digital options are more flexible than binary options, as they have various payout structures and strike prices. They also offer flexible payouts of up to 3,900% or more, while binary options only have fixed payouts of 100% or less. With digital options, traders have more control over strike prices, payout rates, and trade duration. In contrast, binary options are more rigid, with fewer options for customization.

Types of Options

-

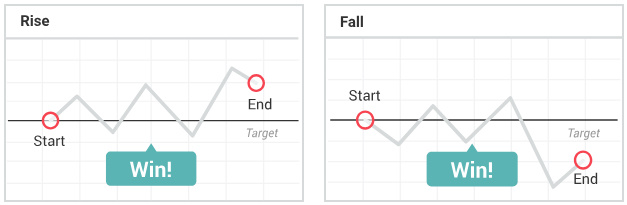

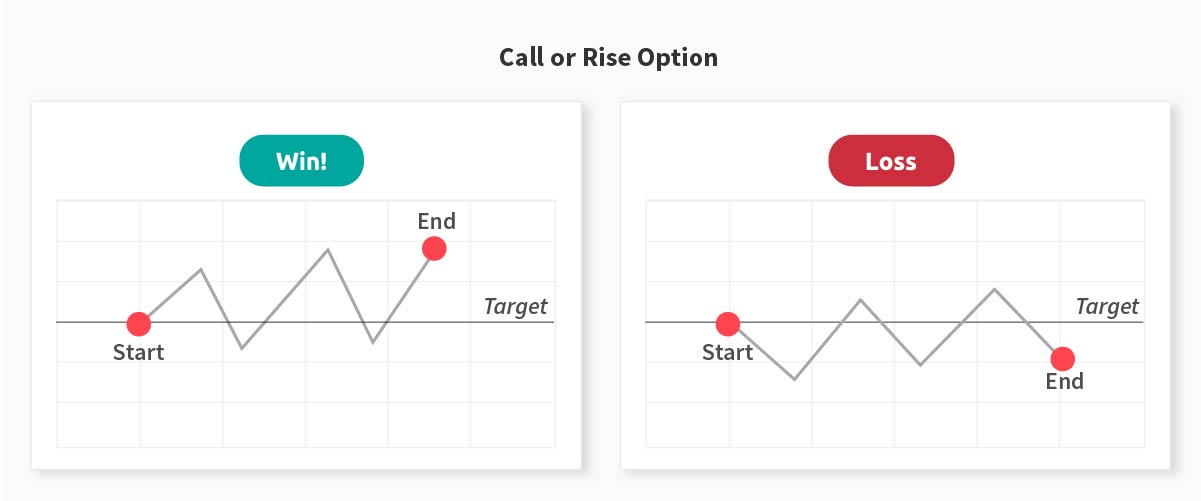

Call options

Call options allow you to predict if the price of an underlying asset will go up and end at or above a certain price within a specific time period. If the price goes as you predicted, you make a profit. They are also called up, high, higher, or rise options by some option brokers, depending on the trading platform you are using. Call options are available and supported by all option brokers.

-

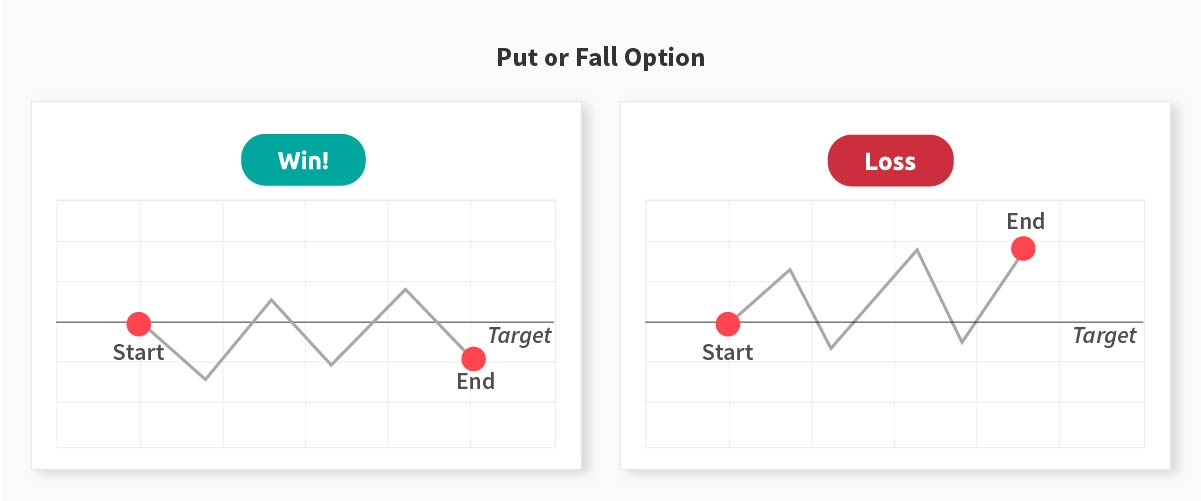

Put options

Put options are the direct opposite of call options. They allow you to predict if the price of an underlying asset will go down and end at or below a certain price within a specific time period. If the price goes as you predicted, you make a profit. They are also called down, low, lower, or fall options by some option brokers, depending on the trading platform you are using. Put options are available and supported by all option brokers.

-

Digit options

Digit options allow you to predict the outcome based on the last digit of a tick. They are currently only available to trade on the Deriv trading platform and are divided into the following categories:

-

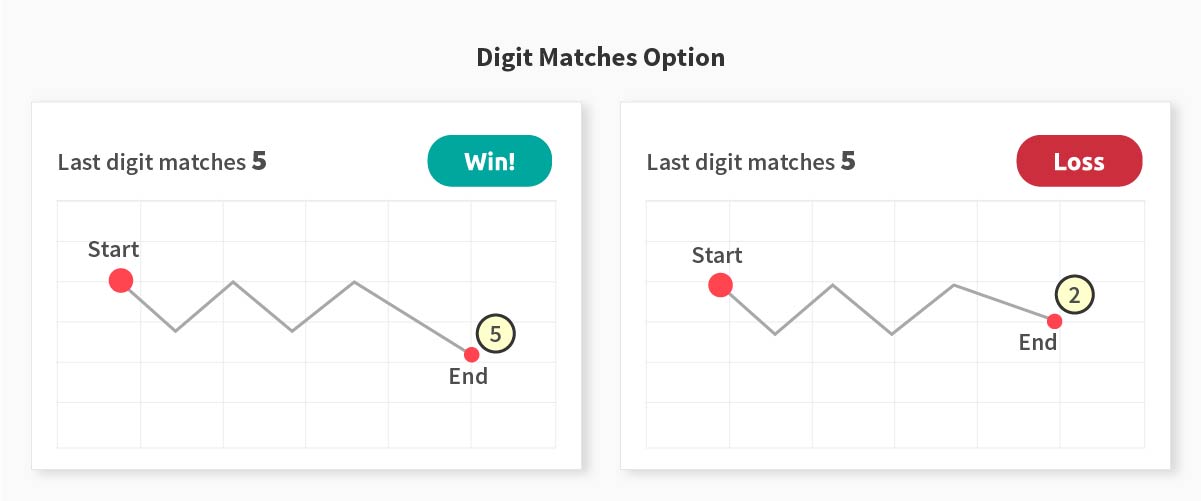

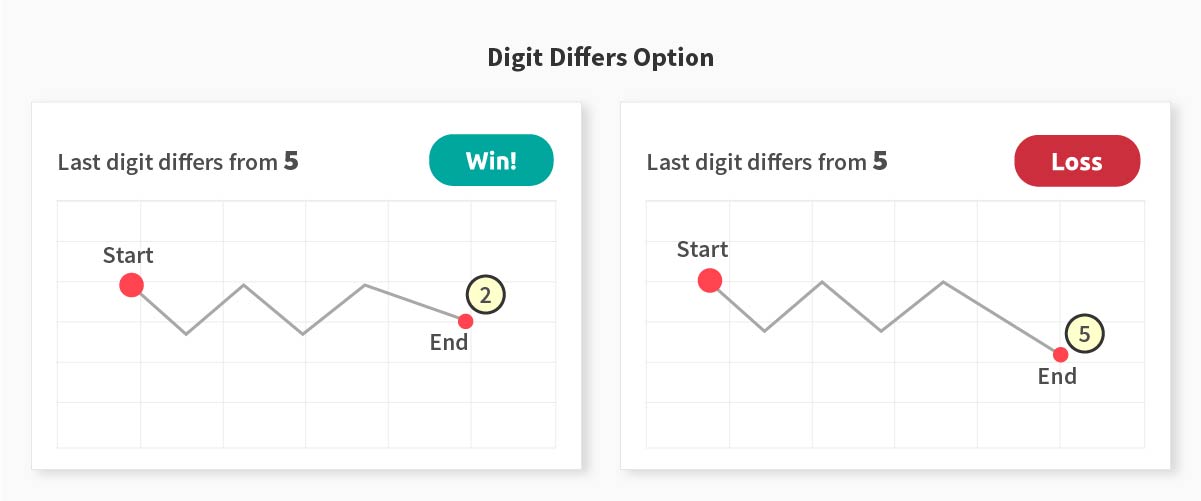

Matches/Differs

Matches/Differs options allow you to predict what number will be the last digit of the last tick of a contract.

-

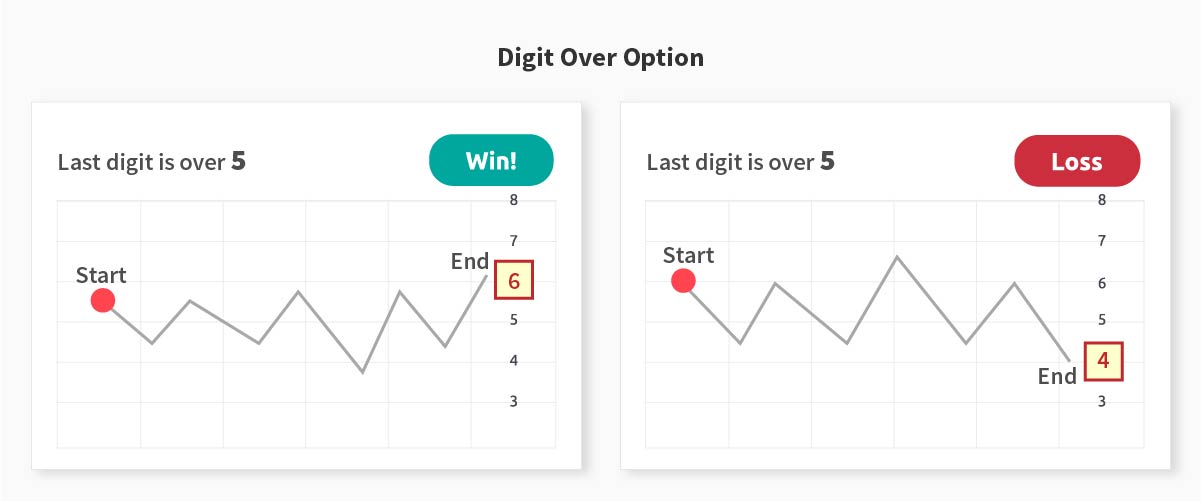

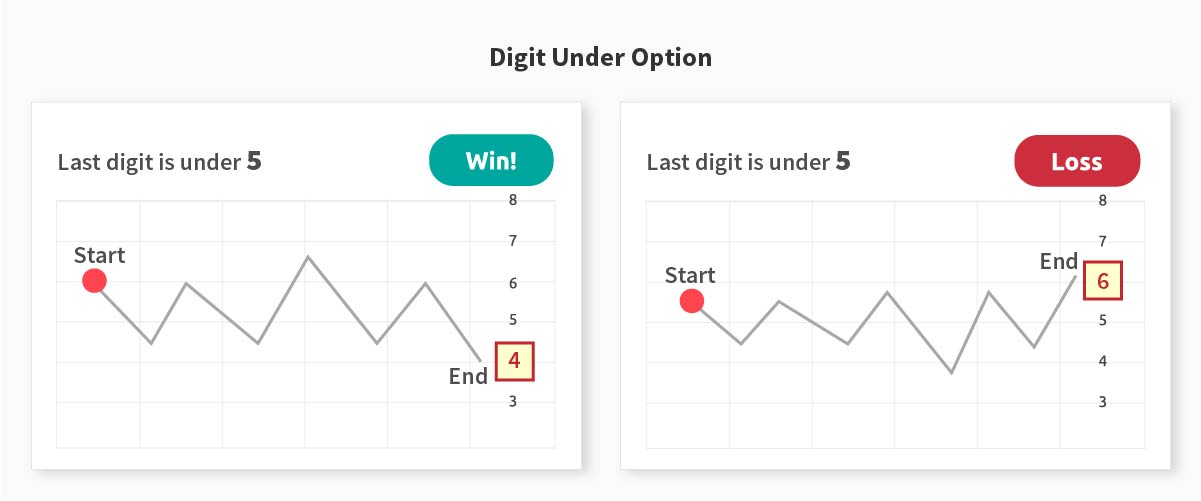

Over/Under

Over/Under options allow you to predict whether the last digit of the last tick of a contract will be higher or lower than a specific number.

-

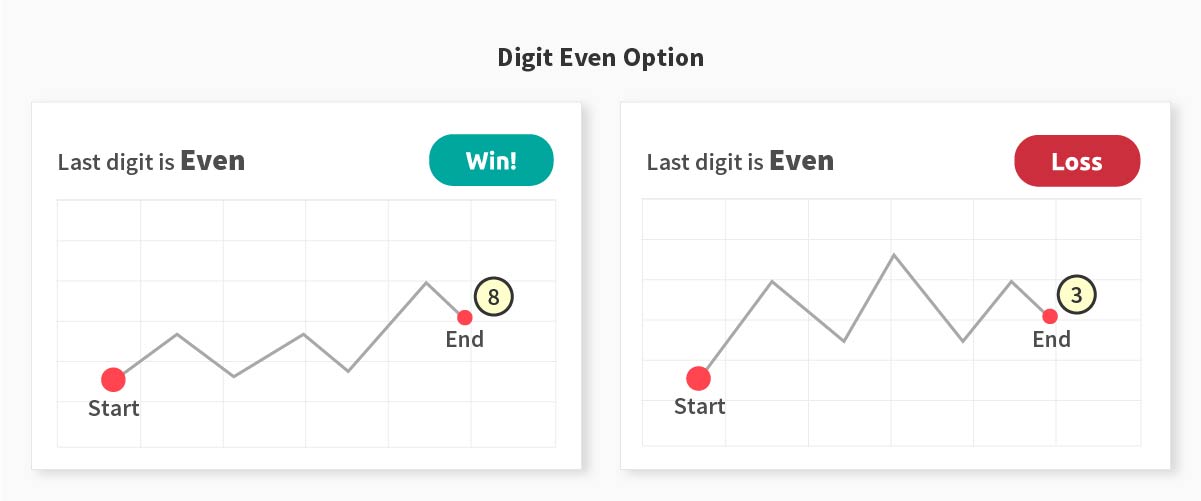

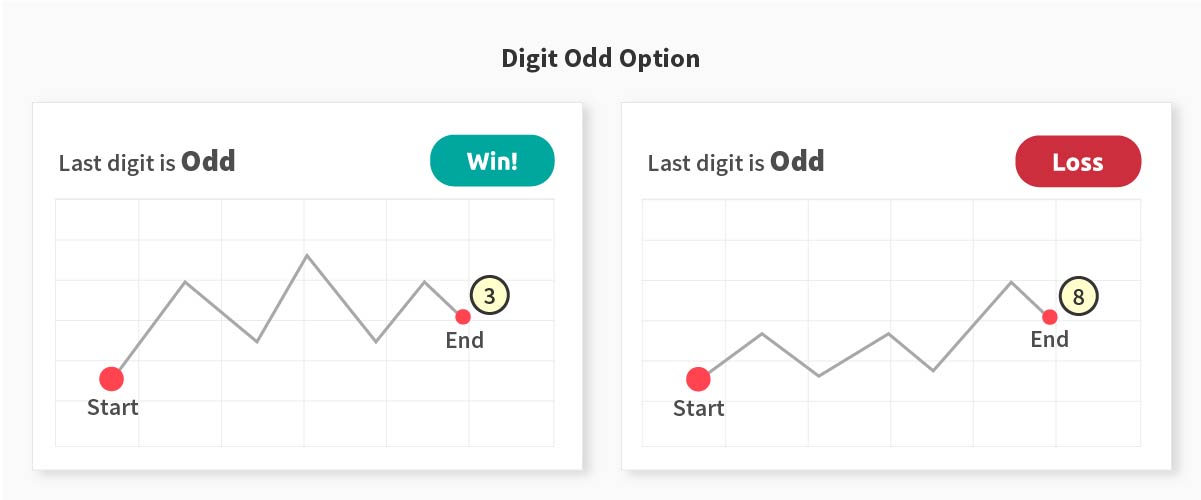

Even/Odd

Even/Odd options allow you to predict whether the last digit of the last tick of a contract will be an even number or an odd number.

-

-

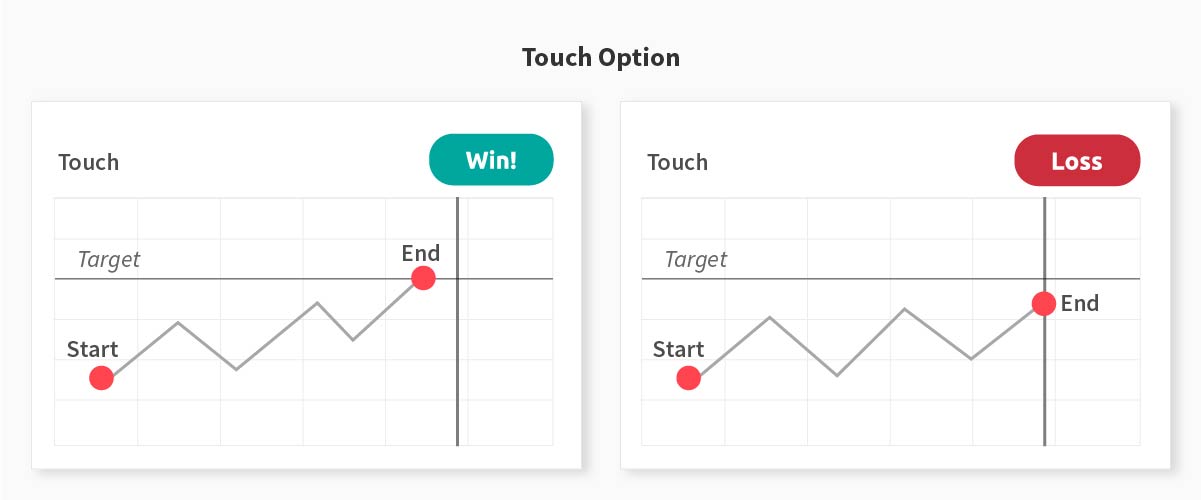

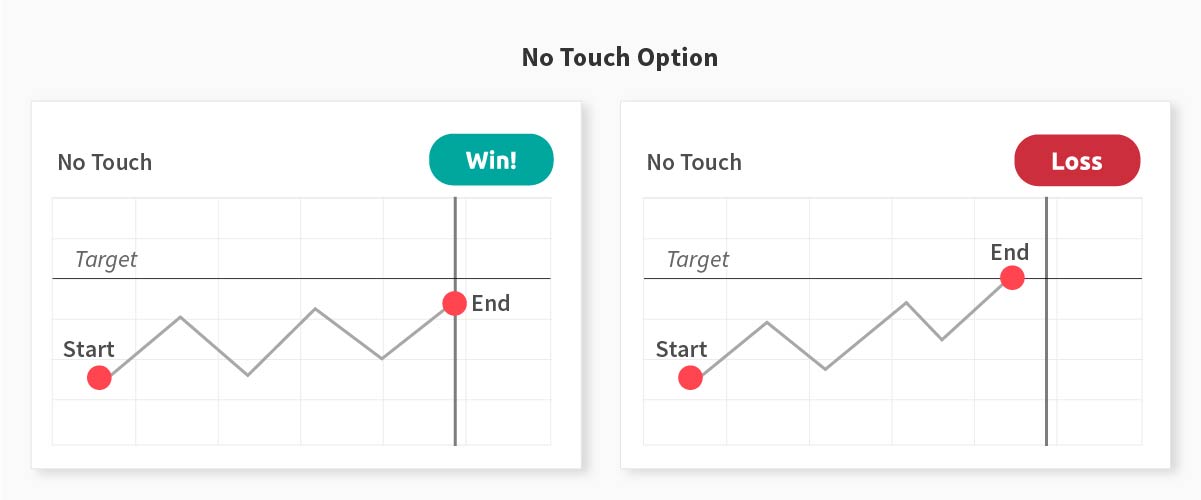

Touch/No touch options

Touch/No touch options allow you to predict whether the market will touch or not touch a price target at any time during the contract period. They are also currently only available on the Deriv trading platform for retail traders.

-

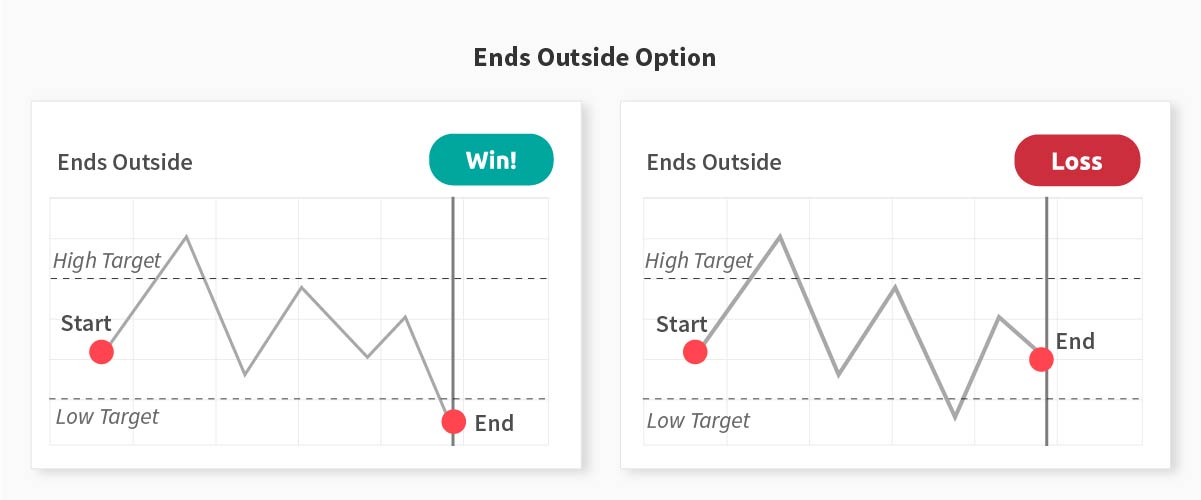

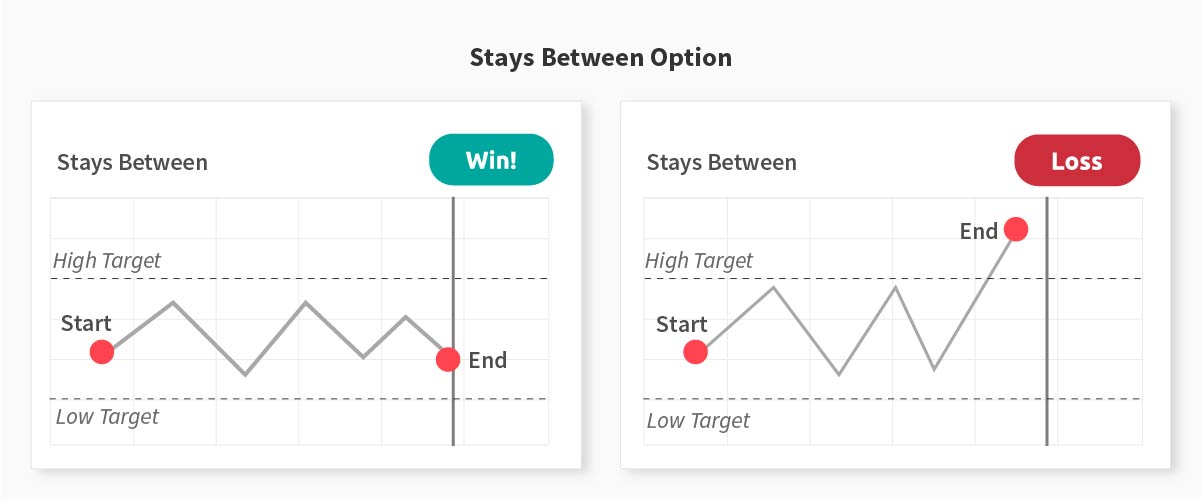

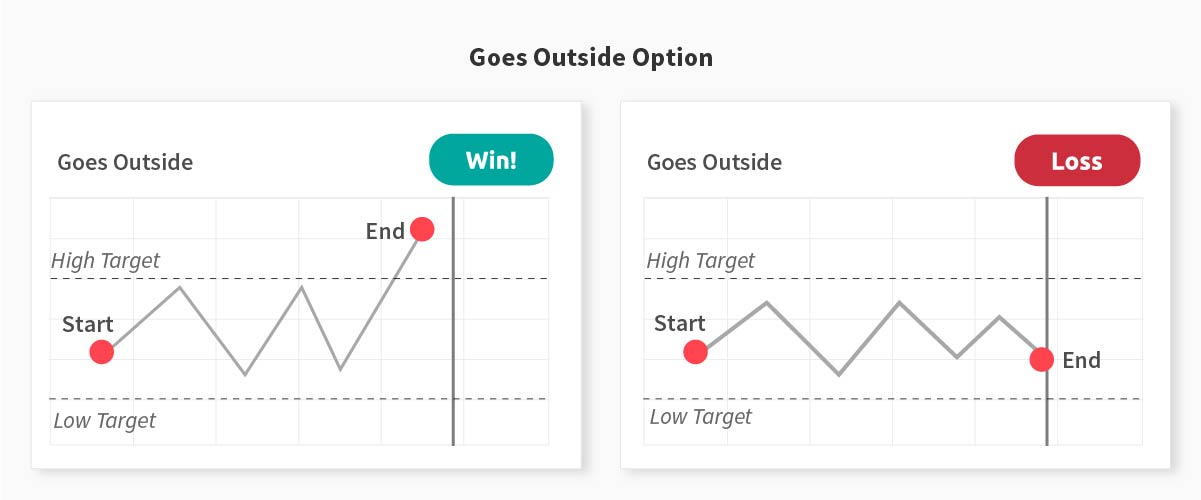

Barrier options or in/out options

Barrier options or in/out options allow you to predict where the price will be in relation to two price targets at the end of the contract period. They are also currently only available on the Deriv trading platform for retail traders. They are divided into the following categories:

-

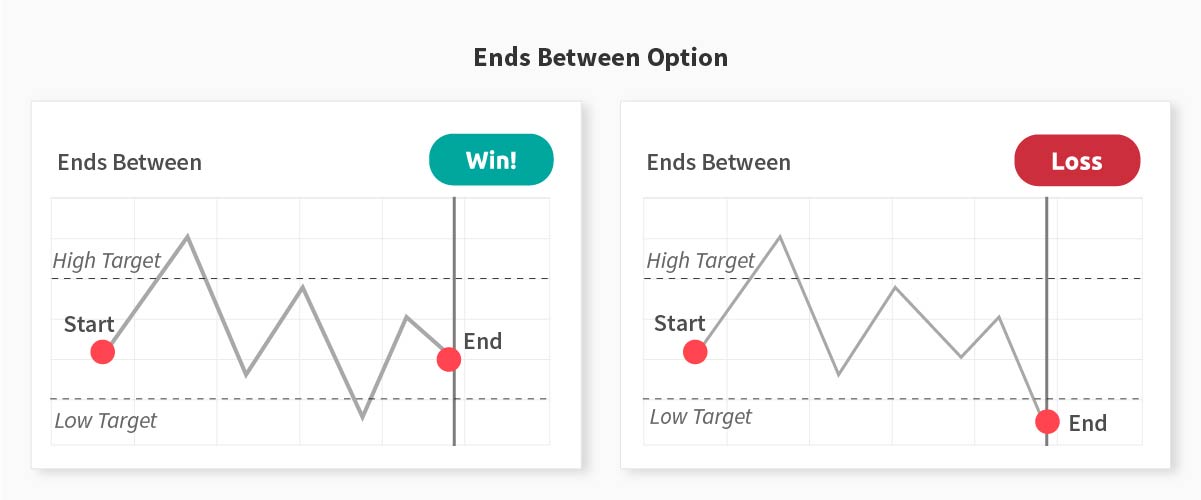

Ends Between/Ends Outside

Ends Between/Ends Outside options allow you to predict whether the exit spot will be inside or outside two price targets at the end of the contract period.

-

Stays Between/Goes Outside

Stays Between/Goes Outside options allow you to predict whether the market will stay inside or go outside two price targets at any time during the contract period.

-

How Do I Choose a Good Digital Options Broker?

A digital options broker is the link between you and the options market. Without an online broker, it would be impossible for you to access and trade options. You open a trading account with a broker and deposit your trading capital with them in order to be able to open and close trades with the aim of generating profits.

So, choosing the right broker is like choosing the right business partner—you want someone who's reliable, trustworthy, and has your best interests at heart because they will have a direct impact on your trading experience and ultimately your profits. But don't worry, we're here to help you make an informed decision. Here are some important things to keep in mind when choosing an options broker:

-

Reputation: Pick a broker that has a good reputation and has been in business for a long time. Choosing a broker with a proven track record can provide peace of mind and ensure a successful outcome.

-

Regulation: Choose a broker that's regulated by a reputable financial authority. This shows that they are trustworthy and reliable.

-

Free Demo Account: All good option brokers will provide you with a free demo account that never expires and is easily reloadable if your demo funds go low, enabling you to practice and test things out at your own pace without any time pressure.

-

Minimum and Maximum Balances: A broker that has at least a $10 minimum deposit and withdrawal requirement is good to trade with since you will be able to deposit or withdraw even small amounts of profit as soon as you want to.

-

Minimum and Maximum Trade Sizes: You want a broker that has a minimum trade size of at least $1 or below to support a small account and a maximum trade size of at least $10,000 or above to support a large account.

-

Payment Methods: You want to be able to withdraw your profits in a quick and efficient way with little or no processing fees or commissions. Always confirm that your broker of choice supports convenient and reliable ways to deposit and withdraw money to and from your country.

-

Customer Support: Choose a broker who is always ready to answer your queries when you need them. A readily accessible live chat system for customer support is a must-have support tool for any reliable broker.

-

Trading Products: Find a broker that has a large number of trading products that you can trade with to help you maximize your chances of making a profit.

-

Trading Platform: Look for a broker that has a trading platform that's easy to use and suits your needs. If you prefer trading on the go, choose a broker that has a mobile trading app that you can use to trade on your smartphone.

Who Is The Best Digital Options Broker To Start Trading With?

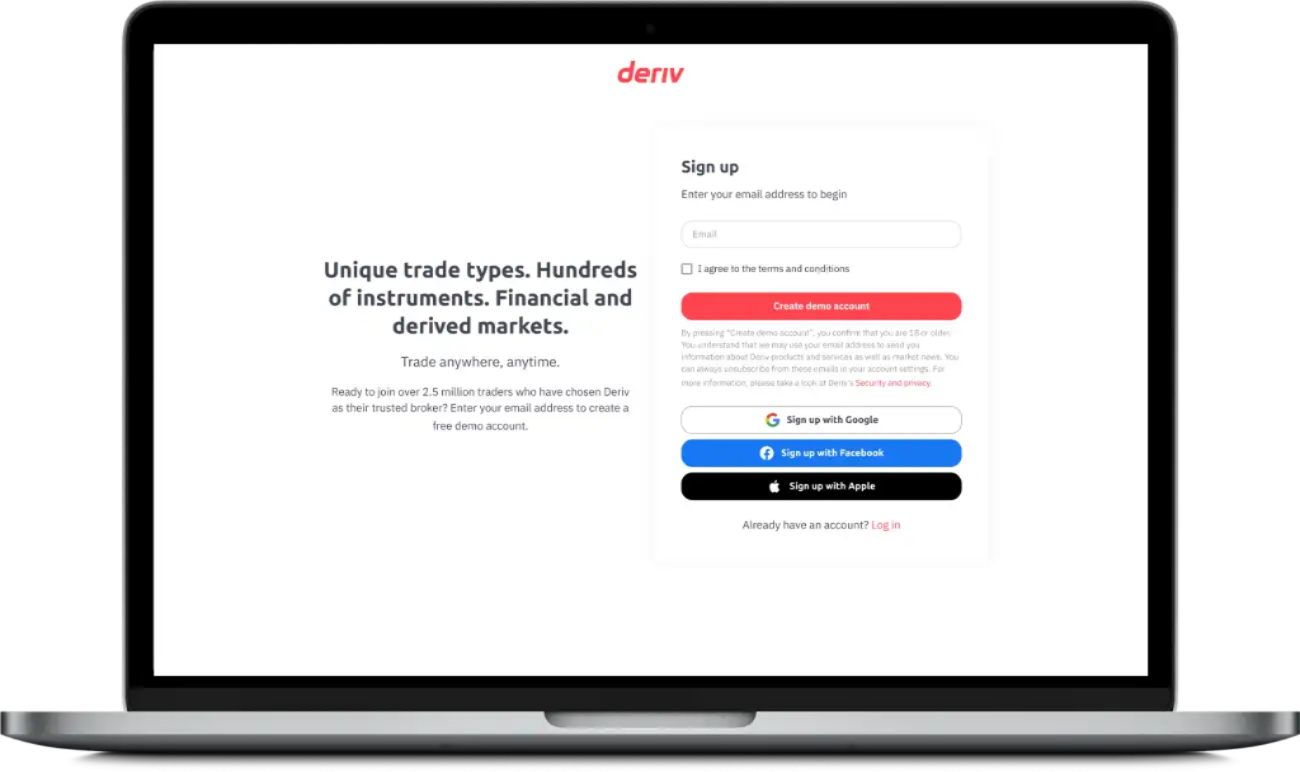

We highly recommend Deriv as the best digital options broker for both novice and experienced traders. However, we understand that traders have unique preferences when it comes to selecting a broker. That's why we have dedicated a comprehensive section to showcase reviews of the top-rated digital options brokers on our brokers page. This will simplify your search for the right broker that suits your needs.

All the brokers featured on our brokers page are fully regulated and reliable. Additionally, they provide free demo accounts to help you assess their platform and offerings before committing to trading with them on a live account.

Understanding Trading Strategies

What Is A Trading Strategy?

A trading strategy is a systematic approach to trading with the goal of making a profit. It involves analyzing market conditions, identifying opportunities, and deciding when and how to enter and exit trades. Having and following a clearly defined trading strategy to the letter will help you stay focused, avoid emotional decisions, and greatly improve your chances of success in the markets.

What Are The Different Types Of Trading Strategies?

-

Technical Trading Strategies

Technical trading strategies are ways to analyze the historical price and volume data of a financial instrument to identify patterns and trends that can help predict its future movements. It's like looking at a map of the stock's past behavior to help navigate its future direction. Technical trading strategies tend to offer positive outcomes as they encourage objective and statistical decision-making in trading.

-

Fundamental Trading Strategies

Fundamental trading strategies involve looking at economic and financial information, such as earnings reports and news events, to figure out if an asset is overvalued or undervalued. Fundamental traders focus on the underlying factors that influence an asset's value, such as the company's financial health, industry trends, and overall economic conditions. However, it can be tricky to analyze these factors since they are more subjective and challenging to understand, especially if the information is unreliable or based on rumors.

-

Hybrid Trading Strategies

Hybrid trading strategies involve combining both technical and fundamental trading strategies into one comprehensive approach. It is important to note that this type of trading requires a high level of expertise and is generally not recommended for new traders, as it may be more complex and potentially impact their success in the markets.

As a digital options trader, you will mainly be trading on very short timeframes, which means you will mainly be using technical trading strategies to make your trading decisions. This will help you maintain objectivity and confidence, thus increasing your profitability in the markets.

How to Choose a Profitable Digital Options Trading Strategy

To choose a profitable digital options trading strategy, you need to look for specific qualities that can improve your chances of success. Some key qualities to consider include:

- Simplicity: A profitable trading strategy should be easy to understand and implement. Look for strategies that don't rely on complex indicators and can be easily followed by both beginners and experienced traders.

- Risk management: A profitable trading strategy should have a well-defined risk management plan that includes setting maximum loss thresholds and profit targets. This can help you minimize losses and protect your trading capital.

- Adaptability: Look for strategies that can be adapted to different market conditions and adjusted to suit your trading style and risk tolerance.

- Realistic expectations: Successful options trading is not about finding a "no loss" strategy but rather focusing on a risk-reward ratio that generates more profits from winning trades than losses from losing trades. By using mathematical probabilities, many traders have achieved long-term success.

By focusing on these qualities when choosing a digital options trading strategy, you will increase your chances of finding a profitable approach that works for you. Remember to test any strategy on a demo account thoroughly before committing to it and to be patient and disciplined in your trading approach.

Once you've finished reading this guide, we encourage you to explore our trading strategies page, where you'll find a wide range of effective trading strategies. However, to get started, we highly recommend trying out the moving averages strategy that we have outlined below. It's a great way to begin your trading journey and gain valuable insights into the market.

Moving Average Digital Options Trading Strategy

The moving average is a tool that traders use to figure out which way the market might go. It's really popular and easy to use. By using it, traders have a better chance of making good predictions and making more money. We want to make things as easy as possible, so we're only going to use the moving average to decide which way to trade.

To implement our trading strategy, we'll use the Deriv Trader trading platform. Please log in to your Deriv Trader account to follow along. If you don't have a Deriv account, it's easy to create one for free using your email.

If you can't open a Deriv account, don't worry; you can still use other brokers such as Pocket Option, IQ Option, Expert Option, Binomo, Nadex, Quotex, or Olymp Trade to implement this strategy. Rest assured, this strategy is adaptable and can be executed on any option broker platform of your choice.

Set Up the Asset, Chart Type, Indicators, and Trade Properties on Deriv Trader

-

Make sure you have signed up and are logged in to your Deriv account. On the "Trader's Hub" page, select "Trade" on Deriv Trader, and then select the "Volatility 10 (1s) Index" from the assets list.

Login and select the "Volatility 10 (1s) Index" in Deriv Trader in 6 easy steps. -

Set up the chart type and chart time interval by selecting the "Area" chart type and "1 minute" time interval.

Select the chart type and time interval in Deriv Trader in 3 easy steps. -

Load the Moving Averages Indicator by selecting "Moving Averages" on the indicators list, then select "Moving Average (MA)", then select "Active" indicators, and select the gear icon on "ma" to change the settings as listed below.

Moving Averages Settings

- Color: Green

- Period: 4

- Field: Close

- Type: Exponential

- Offset: 0

Load the "Moving Averages" indicator in Deriv Trader in 6 easy steps. -

Set up the trade type as "Rise/Fall", the trade duration as "1 minute", and enable the "Allow Equals" check box.

Set up the trade type as "Rise/Fall", the trade duration as "1 minute", and enable the "Allow Equals" check box in 3 steps.

Now that we have set up our trading platform, selected an asset to trade, and loaded the exponential moving average indicator, we are ready to start generating trade signals so we can open new trades.

Rules of the Trading Strategy

-

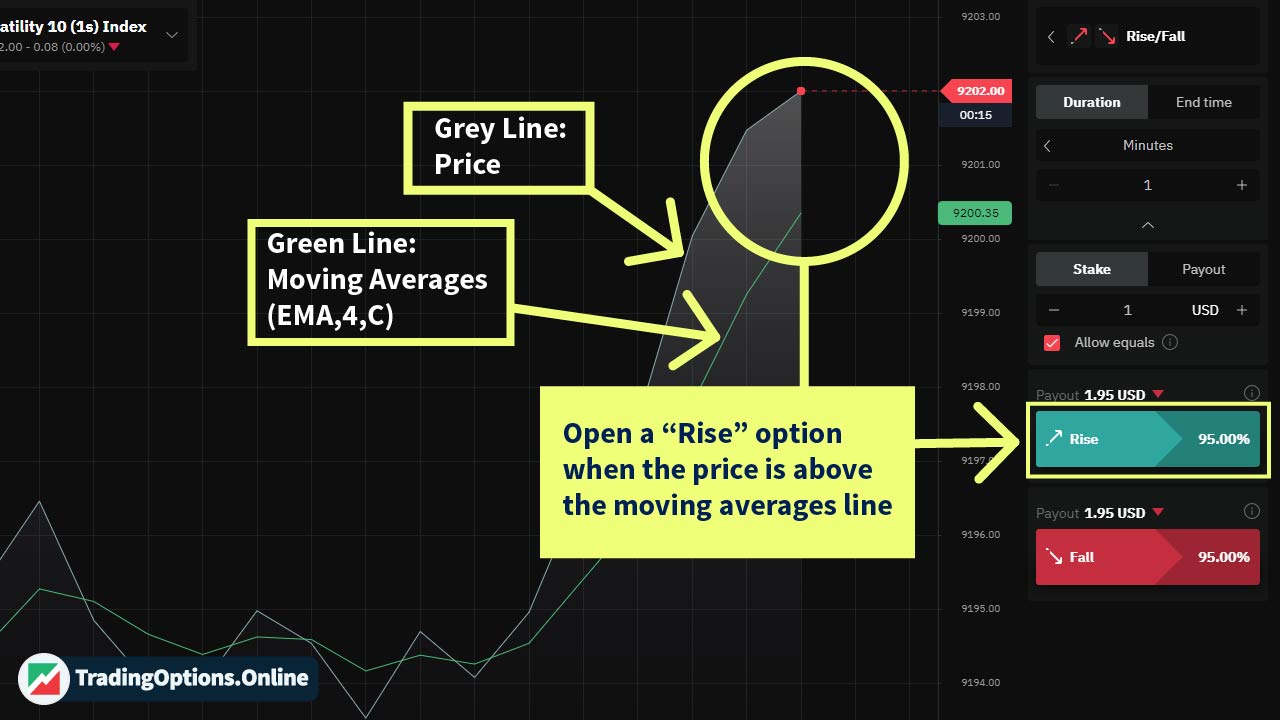

Open A "Rise" Trade

When the price is above the green moving average line, it signals an uptrend, and we should open a "Rise" trade. This type of option may be referred to as a "call," "high," "higher," or "rise" option, depending on the specific trading platform being used.

Opening a "Rise" trade as directed by the moving averages signal in Deriv Trader -

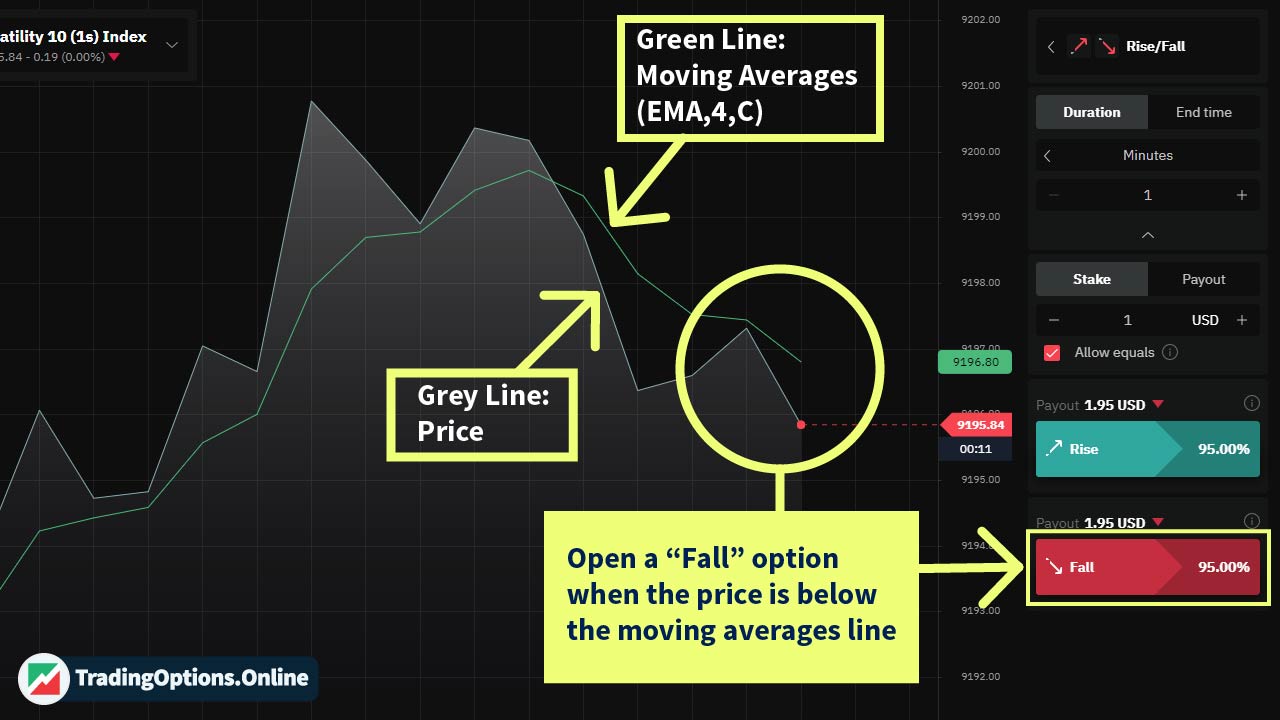

Open A "Fall" Trade

When the price is below the green moving average line, it signals a downtrend, and we should open a "Fall" trade. This type of option may be referred to as a "call," "down," "low," "lower," or "fall" option, depending on the specific trading platform being used.

Opening a "Fall" trade as directed by the moving averages signal in Deriv Trader -

Trade Size Management

- Starting trade size: The initial or starting trade size should be 1% of your available capital.

- Maximum trade size: The maximum trade size should not exceed 20% of the available capital. This is to prevent over-exposure to any single trade, which could result in a significant loss.

Profit Management

After a profitable trade, increase the trade size by recalculating it to 1% of the available capital to help your account grow exponentially.

Loss Recovery and Management

- Losing trades: You should increase the trade size by 250% (multiply your trade size by 2.5) after every losing trade. This will help you recover from the loss and potentially make up for it in the next trade.

- Consecutive losses: If the trade size reaches 20% or more of the available capital due to consecutive losses, you should reduce it back to 1% of the available capital and continue to increase it by 250% after every loss. This will prevent you from risking too much of your capital on a single trade and protect you from potentially losing it all.

Account Profit Target

Setting a daily profit target and loss threshold is key to managing risk and achieving trading goals. For example, if you begin trading with $100 with a daily profit target of 10% and manage to consistently hit your profit target over the course of a month, your account balance could reach approximately $1,744.94. However, it's important to keep in mind that trading always carries risk and losses are always possible, so it's important to use sound risk management strategies and keep your expectations realistic.

Trade Simulation Example

To better understand our strategy, let's run a straightforward simulation using 20 random trade examples. For this simulation, let's assume you have a trading capital of $100, the digital options market conditions provide a 75% payout rate, and our moving average strategy has a success rate of 50% (meaning out of every 20 trades, 10 will be losses, and 10 will be profitable). Here's how you can implement our trading strategy:

| # | Trade Size | Outcome | Payout | Capital After Trade |

|---|---|---|---|---|

| 1 | $1.00 | Loss | $-1.00 | $99.00 |

| 2 | $2.50 | Loss | $-2.50 | $96.50 |

| 3 | $6.25 | Loss | $-6.25 | $90.25 |

| 4 | $15.62 | Win | $11.71 | $101.96 |

| 5 | $1.00 | Loss | $-1.00 | $100.96 |

| 6 | $2.50 | Win | $1.87 | $102.83 |

| 7 | $1.00 | Win | $0.75 | $103.58 |

| 8 | $1.00 | Loss | $-1.00 | $102.58 |

| 9 | $2.50 | Loss | $-2.50 | $100.08 |

| 10 | $6.25 | Win | $4.68 | $104.76 |

| 11 | $1.00 | Loss | $-1.00 | $103.76 |

| 12 | $2.50 | Loss | $-2.50 | $101.26 |

| 13 | $6.25 | Win | $4.68 | $105.94 |

| 14 | $1.00 | Win | $0.75 | $106.69 |

| 15 | $1.00 | Win | $0.75 | $107.44 |

| 16 | $1.00 | Loss | $-1.00 | $106.44 |

| 17 | $2.50 | Win | $1.87 | $108.31 |

| 18 | $1.00 | Loss | $-1.00 | $107.31 |

| 19 | $2.50 | Win | $1.87 | $109.18 |

| 20 | $1.00 | Win | $0.75 | $109.93 |

| Net Profit: $9.93 | Final Capital: $109.93 |

Note: Remember, this is just a simulation showcasing how easy it can be to profit with digital options. For steady profits, consider using technical indicators like exponential moving averages and practicing on a demo account until you're confident in your profitable trading. We've found that using longer time frames and trade durations, especially 15 minutes and above, greatly improves your success and profits.

Please note that the lower your capital, the higher your risk when trading digital options. To significantly reduce your risk, we recommend starting with at least $1,000 or $10,000 if you can afford it. Based on this amount, you can calculate your initial trade size as (0.1% for $1,000) or (0.01% for $10,000) of your capital. This approach provides a wider gap for loss recovery and statistically puts you in a better position to safeguard your profits.

If you plan to start trading with $100 or less, we recommend trading with Deriv as your broker. Deriv allows you to trade in cents on their derived synthetic assets and their minimum trade is only $0.35. This way, you can trade with small amounts of money, minimizing your risk and improving your chances of success.

Remember that trading always carries a certain level of risk, regardless of your capital or trading platform. It is essential to have a solid risk management plan in place and never invest more than you can afford to lose.

You will find that our trading strategy is simple yet very effective in optimizing profits while minimizing risk if it's used as described. By following these rules, you can ensure that you're not overexposing yourself to any single trade while also giving yourself the opportunity to recover from losses and potentially make up for them in the next trade. Remember to always be disciplined and patient when trading, and don't let emotions get in the way of making sound decisions.

Where Do I Get Capital For Digital Options Trading?

In order to start making money trading digital options, you need to have trading capital. Here are some potential sources of capital that you may consider and some that you should avoid:

Best Trading Capital Sources

- Monthly budget allocation: The best way to fund your digital options trading account is by allocating a portion of your monthly income for trading. Treat it as a recurring expense, much like a utility bill. Allocate 10% or more of your monthly earnings to trading capital. If you lose your trading account balance, just add new funds and continue trading. This approach helps you become an experienced trader quickly, ensures trading continuity, and boosts your chances of long-term profitability. Many experienced professional traders use a similar system.

- Savings: You can use your personal savings as your source of capital for digital options trading.

- Profits from other businesses: You can reinvest the profits from other businesses or income sources you have to trade digital options and further multiply your money.

- Trading competitions: If you're broke and can't find a way to source trading capital, don't worry. Digital options trading competitions offer a potential solution. By competing and winning, you can use the cash prize to fund your trading account and get started in the market. Here are the best digital options brokers that offer trading competitions:

Bad Trading Capital Sources

The primary rule of trading is to never invest money that you cannot afford to lose. We cannot emphasize strongly enough how important it is to follow this rule. You should avoid risking money that could negatively impact your life, your family's well-being, or anyone who is significant to you in the event of losing your trading account.

Below are some of the trading capital sources we believe you should always avoid:

- Loans: Any type of loan, including loans from friends and family, credit cards, or bank loans, should not be used as a source to fund your trading account.

- Emergency savings: Only use savings intended for investment purposes since, in the event of losses, they will not impact you in a seriously negative way.

- Money for utilities and living expenses: This is also a no-go source to fund your trading account since it can impact you negatively should your trades generate losses.

- Retirement fund: If you must invest your retirement fund in trading digital options, make sure to not invest more than 10% of it.

Trading Psychology

When it comes to trading, psychology is the most crucial factor that will have a significant impact on your success. It involves your mental and emotional state as a trader while making trading decisions and dealing with the outcomes of those decisions.

One of the most important aspects of trading psychology is managing emotions. As a trader, you are likely to experience a range of emotions, including fear, greed, and anxiety. These emotions can cloud your judgment and lead to impulsive decisions that result in losses, so you must learn to control them.

To overcome these emotions, it's important to have a solid trading plan that outlines your goals, risk tolerance, and entry and exit rules, like our simple moving averages strategy you learned earlier. Stick to your plan and avoid making impulsive decisions based on emotions.

Another key aspect of trading psychology is discipline. Discipline involves sticking to your trading plan and avoiding overtrading, which can lead to losses. It also involves being patient and waiting for the right opportunities to enter or place a new trade.

One way to maintain discipline is to keep a trading journal where you record your trades, emotions, and reasons for making each trade. This will help you identify patterns and improve your decision-making process.

It's also very important to have a positive attitude and a growth mindset. Instead of viewing losses as failures, see them as opportunities to learn and improve your trading skills. Avoid blaming external factors for your losses and take responsibility for your decisions.

In short, trading psychology is an essential part of becoming a successful trader. By managing your emotions, maintaining discipline, and having a positive attitude, you will achieve your trading goals.

All Set for Trading

Summary and Key Takeaways

Congratulations! You have reached the end of our digital options trading guide! By following all the sections, you are now fully equipped to trade like a professional. As a final step, we suggest reviewing everything you have learned. If you still feel unsure about any topic, revisit it and read through it again.

Key Takeaways

Throughout this guide, you have acquired a wealth of knowledge on digital options trading. Let's recap what you have learned:

-

Benefits of Digital Options Trading

You are now aware of the significant advantages that come with trading digital options. These include potential high returns, flexibility in trade durations, and the ability to profit from both rising and falling markets.

-

Requirements of Digital Options Trading

You have gained insights into the essential prerequisites for starting your digital options trading journey. Understanding the basic concepts of financial markets, having access to a reliable internet connection, and having a trading account are key elements to getting started.

-

Basics of Digital Options:

You have developed a clear understanding of how digital options function. You now know how to use these financial instruments to generate profits online. Whether it's predicting price movements or setting specific price targets, you have learned the fundamentals necessary to make informed trading decisions.

-

Choosing a Digital Options Broker

Selecting the right digital options broker is crucial to your trading success. You have learned what qualities a trustworthy broker should possess, enabling you to make an informed decision. Additionally, we have provided a dedicated broker page to assist you in reviewing and selecting the broker that aligns with your specific needs and preferences.

-

Trading Strategies Basics:

You now know what trading strategies are, including their types and applications. By implementing a well-defined trading strategy, you will increase your chances of success. Feel free to take a deep dive into our dedicated trading strategies page, where a vast array of proven and impactful trading strategies awaits. Unleash your trading potential by exploring and implementing these strategies to achieve your financial goals.

-

Moving Average Trading Strategy and Money Management:

You now have access to a powerful trading strategy that combines exponential moving averages to identify market trends. This strategy is complemented by a straightforward money management system, ensuring effective capital management to safeguard your profits and minimize risk. With this comprehensive approach, you can start trading right away, confident in your ability to sustain and grow your profits while maintaining a controlled level of risk.

-

Sourcing Trading Capital

You have discovered the best ways to obtain funds for your trading account. Additionally, we have highlighted certain sources that should be avoided due to their potential risks. Understanding these options will enable you to secure the necessary capital to support your trading activities.

-

Emotional Intelligence and Management:

Recognizing the impact of your emotional state on trading outcomes is crucial. By gaining a basic understanding of emotional intelligence and its significance in trading, you are better equipped to manage your emotions and make rational decisions. This will greatly contribute to your overall success as a trader.

In conclusion, it's important to remember that trading is not a guaranteed path to wealth but rather a skill that requires time, effort, and a disciplined approach. As a responsible trader, it will be crucial for you to prioritize your education and practice your skills before diving into live trading. Therefore, I strongly recommend that you begin your trading journey by utilizing a demo account. Treat this phase as a learning opportunity for honing your skills and fine-tuning your approach.

By starting your trading journey on a demo account, you will develop your skills, test your strategies, and gain the necessary confidence to make informed decisions. Once you are consistently profitable on your demo account and feel confident in your trading abilities, it will be time to take the next step. Switch to a real trading account and deposit your trading funds. However, it's crucial to remember that trading with real money involves inherent risks, and you should only trade with an amount you can afford to lose.

Remember, success in trading requires a combination of knowledge, experience, discipline, and patience. Trading is a journey, and the learning process is ongoing. Embrace the challenges, stay focused, and never stop improving. With dedication and perseverance, you will surely unlock the profitable bounty of the financial markets and embark on a rewarding trading venture.

We sincerely wish you all the best, happy trading, and many profitable days ahead.

Start Trading With Deriv Today

Open your free Deriv account and turn your trading goals into profits!

Open A Deriv Account