Moving Average Digital Options Trading Strategy

Introduction

You are about to learn how you can use the most popular and widely used technical trading indicator to help you net some neat digital options profits consistently in a relatively short time and with less effort. The moving average indicator is a beloved tool by the majority of the most profitable traders. I love this strategy because it's very basic and easy to implement.

Strategy Setups

Instrument/Asset

This strategy can be traded on any tradable asset. I recommend you trade it on Deriv's volatility indices for higher payouts and 24/7 trade availability.

Indicators Setup

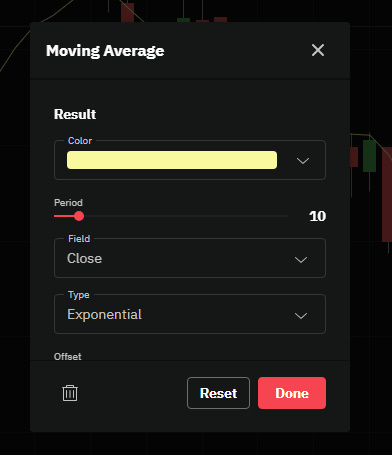

Exponential Moving Average with the following settings:

- Period: 10

- Method: Exponential

- Price applied to: Close

- Line color: Yellow

- Offset/shift: 0

Chart Timeframe and Option Duration

You can use any timeframe you prefer, but make sure that the chart timeframe is four or five times larger than the option trade duration. For example, if you load the moving average indicator on the five-minute chart timeframe, then the option trade duration should be one minute long.

Broker

Trade this strategy using any digital option broker. I recommend you use Deriv or IQ Option, Olymp Trade, Pocket Option, Expert Option, Binomo, Quotex, Nadex.

Supported Option Types

Use this strategy to trade any of the following option types:

- Call and Put Options.

- Rise and Fall Options.

- Higher and Lower Options.

- Touch and No Touch Options.

Non-Supported Option Types

Don't use this strategy to trade the following option types:

- Barrier Options, e.g., Ends Between/Ends Outside and Stays Between/Goes Outside

Strategy Rules for Entry

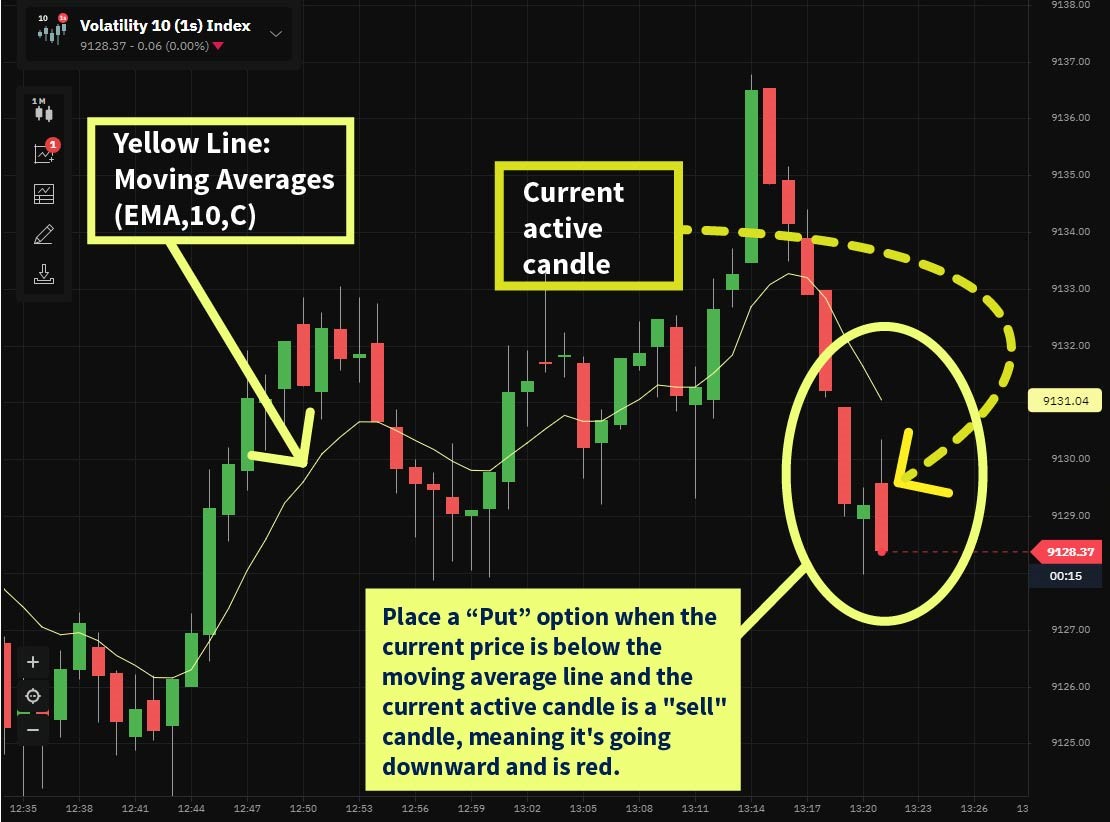

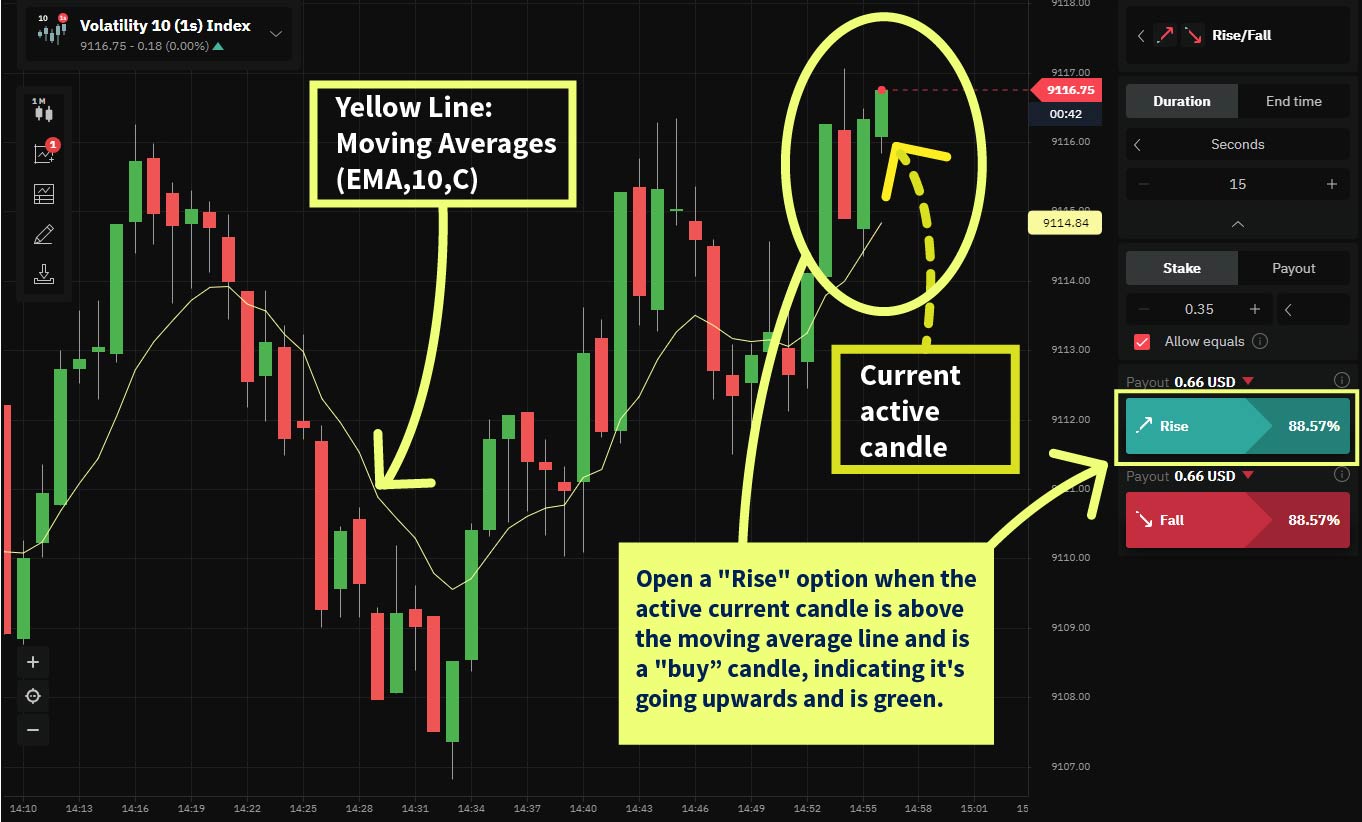

Rules for a "Call", "Rise," or "Higher" option entry.

Open a "Call" option when the active current candle is above the moving average line and is a "buy” candle, indicating it's going upwards and is green.

Rules for a "Put", "Fall," or "Lower" option entry.

Open a "Put" option when the active current candle is below the moving average line and is a "sell” candle, indicating it's going down and is red.

Trade Size Management

- Starting trade size: The initial or starting trade size should be 1% of your available capital.

- Maximum trade size: The maximum trade size should not exceed 20% of the available capital. This is to prevent over-exposure to any single trade, which could result in a significant loss.

Profit Management

After a profitable trade, increase the trade size by recalculating it to 1% of the available capital to help your account grow exponentially.

Loss Recovery and Management

- Losing trades: You should increase the trade size by 250% (multiply your trade size by 2.5) after every losing trade. This will help you recover from the loss and potentially make up for it in the next trade.

- Consecutive losses: If the trade size reaches 20% or more of the available capital due to consecutive losses, you should reduce it back to 1% of the available capital and continue to increase it by 250% after every loss. This will prevent you from risking too much of your capital on a single trade and protect you from potentially losing it all.

Example Trade and Setup

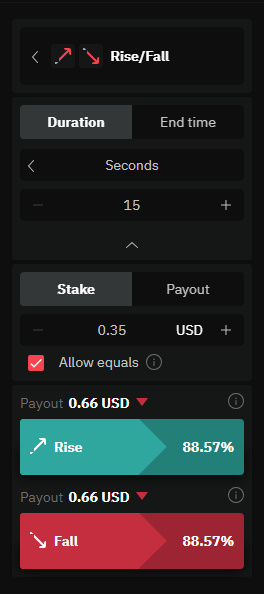

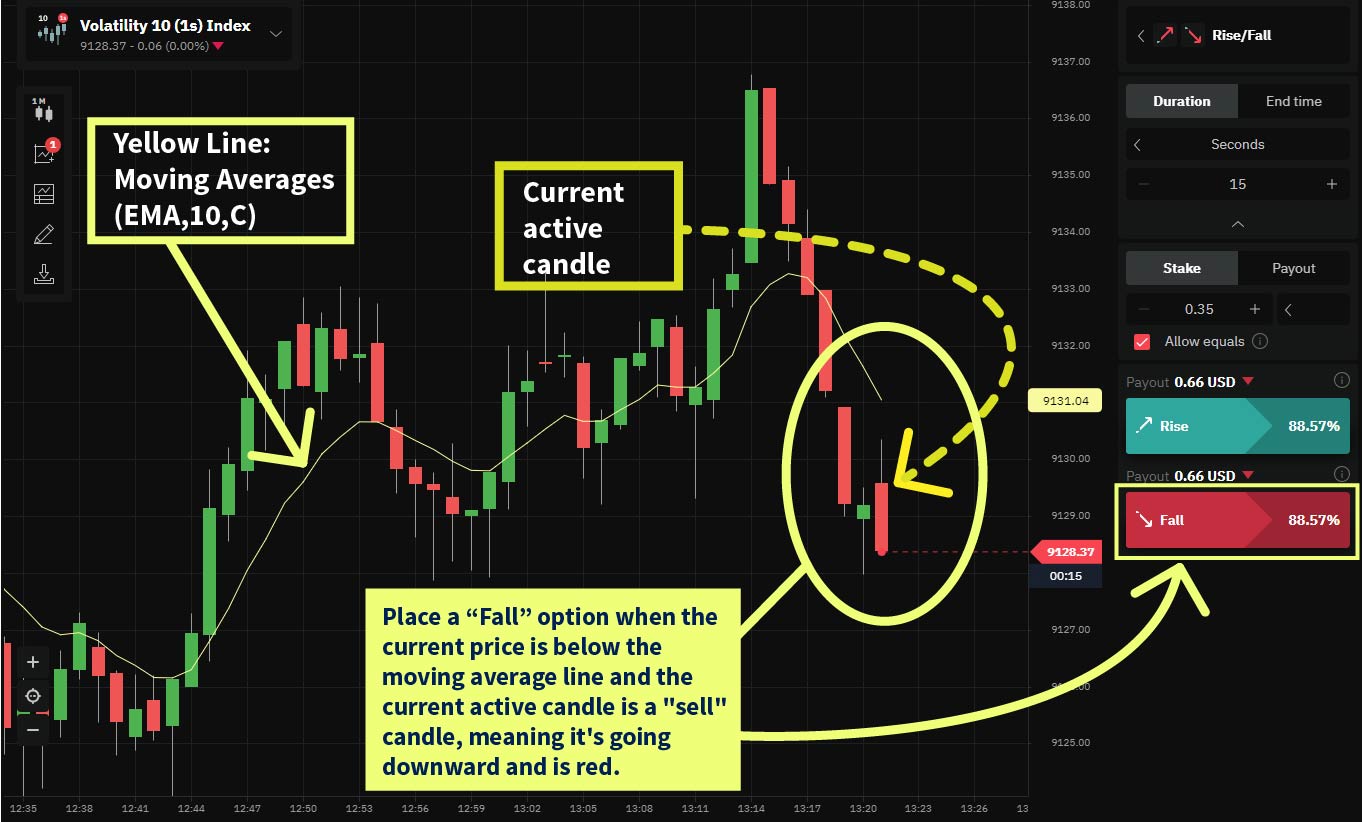

For this demonstration, I will be using a one-minute chart timeframe to trade the volatility 10 (1s) Index fifteen-second "Rise/Fall" options on the Deriv Trader platform.

You will need to log in to Deriv Trader to follow along. If you don't have a Deriv account, click here to open a free demo account and get instant access to the free Deriv Trader platform.

-

Select the volatility 10 (1s) index as the asset to trade.

Selecting the volatility 10 (1s) index in Deriv Trader. -

Set the chart type to candle type, and the time interval to 1 minute.

Deriv Trader chart settings. -

Set up the moving average.

Deriv Trader Moving Average indicator settings. -

Set the option type to "Rise/Fall" with the allow equals check box checked and the option trade duration to 15 seconds.

Monitor the charts and open a "Rise" option when the active current candle is above the moving average line and is a "buy” candle, indicating it's going upwards and is green.

Monitor the charts and open a "Fall" option when the active current candle is below the moving average line and is a "sell” candle, indicating it's going down and is red.

Assuming that our trading capital is $100 and the volatility 10 (1s) index has an 88% payout rate, we will implement our trading strategy as follows:

- For our first trade, we will invest 1% of our available trading capital, which amounts to $1.

- We place our first trade in the direction the moving average is pointed to, as illustrated above, with a $1 trade size, and wait for the contract to expire.

- Assuming the trade is successful, we will receive a payout of $0.88, and our new account balance will be $100.88.

- Since the previous trade was a profit, we will invest $1 again as the trade size since it's 1% of our capital.

- If this trade is not successful, we will lose the $1 investment, leaving our new account balance at $99.88.

- Since the previous trade was a loss, we will now increase our next investment amount by 250%. Thus, our next trade size will be $2.50 ($1 x 2.5 = $2.5).

- Assuming we win this trade with an 88% payout, our profit will be $2.20.

- Considering the $0.88 profit from the first trade, the $1 loss from the second trade, and the $2.20 profit from the third trade, our new account balance is now $102.08. This means we have made an overall profit of $2.08, or a 2.08% return on our investment.

Note: By using moving averages to determine the direction in which we place our trades, we can reduce the number of back-to-back losses we experience. This increases our loss recovery rate and profits. If you have many consecutive losses that cause your trade size to exceed 20% of your available capital, you should strictly always reduce your trade size back to 1% of your available capital and then increase it by 250% after each loss. This will prevent you from blowing your account.

Conclusion

This option trading strategy relies on solid mathematical principles. When you grasp the probabilities behind it, you can potentially earn substantial profits. By using the moving average indicator and assessing the current active candle to gauge market direction, you gain an advantage and minimize consecutive losses. This approach helps you recover from losses without the need to significantly increase your trade size.

Before implementing this strategy with your actual capital, practice it in a demo account to confirm its profitability with your investment size. Always remember that your emotional and psychological state play a crucial role in achieving success in financial markets. Therefore, ensure you're trading with funds you can afford to lose to maintain emotional stability and control.

I wish you success and hope this strategy brings you steady, continuous, and big profits in the long run.

Trade This Strategy On Deriv Trader

Open your free Deriv account and turn your trading goals into profits!

Open A Deriv Account