Deriv Broker Review 2024: Unbiased Analysis and Insights

Key Points About Deriv

Deriv is the most trusted and transparent option broker, with the longest and most reliable track record. It offers the widest range of trading products compared to other brokers, making it the best choice for both beginners and experienced option and CFD traders.

Open Deriv's Official Website

| Year Founded | 1999 |

| Minimum Trade Size | $0.35 |

| Option Trade Duration | 1 second/tick to 1 year |

| Payout | Up to 3,900% |

| Minimum Deposit and Withdrawal | $5 (no minimum for cryptocurrencies) |

| Weekend Trading | Yes (24/7 Trading available) |

| Free Demo Account | Yes |

| Copy Trading | Only on MT5 |

| Trading Robots Supported | Yes |

| Deposit and Withdrawal Options | Bank Wire Transfer, Credit and Debit Cards, E-wallets, Cryptocurrencies |

| Trading Platforms | Deriv Trader (DTrader), MetaTrader 5 (MT5), Deriv X, Deriv EZ, Deriv GO, Deriv Bot (DBot), Binary Bot and SmartTrader |

| Compatible OS | Windows, Mac, Linux, Android, iPhone and iPad |

| Tradable Assets | Forex, ETFs, stocks, indices, cryptocurrencies, commodities, and derived indices. |

| Multi-lingual Customer Support | Yes |

| Customer Service Hours | 24/7 (Always available any time) |

| Regulators | British Virgin Islands Financial Services Commission (BVIFSC), Malta Financial Services Authority (MFSA), Labuan Financial Services Authority (LFSA) and Vanuatu Financial Services Commission (VFSC) |

| Restricted Countries | Alderney, Belarus, Canada, Cayman Islands, Cuba, Guernsey, Guam, Hong Kong, Israel, Jersey, Jordan, Malaysia, Malta, Rwanda, Paraguay, Singapore, United Arab Emirates, and United States. |

| Islamic Account (Swap-Free) | Yes |

| Corporate or Business Accounts | Yes |

| Maximum Leverage | 1:1000 |

| Open an account | Click Here To Open A Deriv Account |

Deriv's History And Reputation

What's Deriv's History?

Deriv, a prominent online broker, has become a major player in the world of financial trading. With a history dating back to 1999, when it was known as BetOnMarkets.com, Deriv has been instrumental in shaping the retail options market into what it is today.

Founded by Jean-Yves Sireau and owned by Regent Markets Group, Deriv is a pioneer in introducing the concept of binary options to retail traders. They developed the world's first fixed-odds trading system and platform, revolutionizing online trading at a time when it was still in its early stages.

In 2013, BetOnMarkets.com underwent a rebranding and became Binary.com, offering an expanded range of trading features and charting applications. Then, in 2020, the broker rebranded once again, this time as Deriv.

What's Deriv's Reputation?

Today, Deriv stands as a leading online broker, offering a wide array of trading options, including digital and binary options, CFDs, and derived financial products. Its long history and innovative spirit have made it a trusted first choice for millions of traders around the world, shaping the retail options market and providing a platform for traders to pursue their financial goals.

What Type of Account Can I Open with Deriv?

Options and Multipliers Trading Account

Deriv provides a single basic account for options trading across multiple platforms, including Deriv Trader, SmartTrader, Deriv GO, DBot, and Binary Bot.

CFD Trading Accounts

Deriv offers three account types for leveraged CFD trading on the MT5, Deriv X, and Deriv EZ platforms:

- Financial account: This is the most basic account type and is suitable for most traders. It offers a wide range of assets to trade, including forex, ETFs, commodities, cryptocurrencies, and stocks.

- Financial STP account: This account type is designed for traders who want to trade with lower spreads. It offers tighter spreads than the Financial account and is also eligible for STP execution.

- Synthetic account: This account is designed for traders who want to trade synthetic indices round-the-clock. Synthetic indices are not real-world assets, but they are based on the prices of real-world assets. This account offers the highest leverage among the three account types and allows continuous trading, even on weekends. Trade 24/7, as the market never closes.

The best part about all Deriv accounts is that they are paired with a free demo account. A demo account is a virtual trading account that allows you to practice trading with virtual money. This is a great way to learn how to trade without risking any real money.

To open an account with Deriv, you need to provide the following information:

- Your name

- Your email address

- Your phone number

- Your country of residence

You will also need to choose a password for your account.

Once you have provided the required information, you will be able to deposit funds into your account and start trading.

What Types of Trades Does Deriv Offer?

Deriv offers a wide range of trade types, catering to traders with both small and large account sizes. Whether you prefer trading CFDs or options, Deriv ensures that all traders can pursue their investment goals. Moreover, you have the flexibility to trade at any time of the day, including weekends.

Options

Below is a comprehensive list of the option types you will find at Deriv:

- Digital or Binary options: The most common option type on Deriv. It pays a fixed amount if the underlying asset reaches a specific price within a given time. If the target price is not reached, you lose your entire investment.

- Lookbacks: These options pay out based on the highest or lowest price achieved by the market during the contract duration. For example, if you buy a lookback option with a target price of 100 and the market reaches a high of 105, you receive a payout of 5.

- Call/Put spreads: These options involve trading the difference between the prices of a call option and a put option. For instance, if you purchase a call/put spread with a strike price of 100 while the market price is 95, you profit if the market price rises above 100 but lose if it falls below 95.

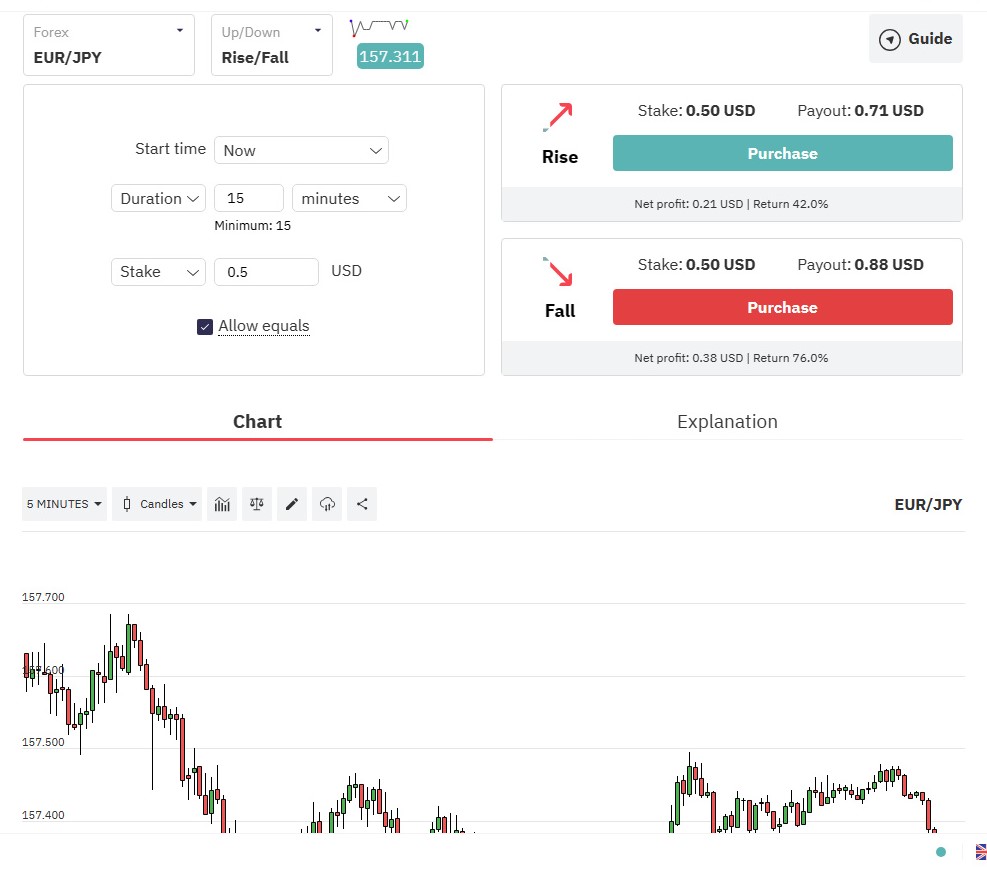

- Up/Down: These options pay a fixed amount if the underlying asset closes higher or lower than the entry price at the contract's end.

- In/Out: These options pay a fixed amount if the underlying asset closes between or outside two specified price targets by the end of the contract.

- Digits: These options pay a fixed amount if the last digit of the last tick of the underlying asset matches a specific number at the contract's end.

- OneTouch: These options pay a fixed amount if the underlying asset touches a specific price at any time during the contract.

- NoTouch: These options pay a fixed amount if the underlying asset does not touch a specific price at any time during the contract.

- Touch and NoTouch: These options pay a fixed amount if the underlying asset touches or does not touch a specific price at any time during the contract.

- Tunnel: These options pay a fixed amount if the underlying asset closes within a certain price range at the contract's end.

- Range: These options pay a fixed amount if the underlying asset closes within a specific price range at any time during the contract.

Note: For a full, detailed list and explanation of the different options types available on Deriv, click on the following link to visit Deriv's website's options page.

Multipliers

Deriv multipliers offer the benefits of leveraged trading and the risk control of options. With multipliers, you can amplify your potential profits when the market moves in your favor. On the other hand, if the market goes against your prediction, your losses are limited to the amount you have invested.

CFDs

A contract for difference (CFD) is a way to trade on the price changes of an asset without actually owning it. With Deriv, you can trade CFDs using high leverage, which means you can control larger positions with a smaller amount of money in your trading account. Higher leverage allows you to trade with less capital. Deriv also offers tight spreads, which is the difference between the buying and selling prices. Tight spreads mean lower costs when entering the market.

What Payout Rates Does Deriv Offer For Options?

The payout rates for options on Deriv are constantly changing and vary depending on the type of option and the underlying asset. However, in general, Deriv offers payout rates of up to 3,900% for digital options and up to 95% for other types of options.

Below is a table of the payout rates for some of the most popular types of options on Deriv:

| Type of option | Payout rate |

|---|---|

| Digital options | Up to 3,900% |

| Up/Down options | Up to 95% |

| In/Out options | Up to 3,900% |

| Lookback options | Up to 3,900% |

| Digit options | Up to 850% |

What Trade Durations Does Deriv Offer For Options?

Deriv provides a range of options trade durations, starting from as short as 1 second and going up to 365 days. The available trade duration depends on the type of option and the underlying asset you choose to trade.

What Trading Platforms Does Deriv Provide?

Deriv provides a selection of trading platforms tailored to suit different trading preferences and styles.

Deriv's Trading Platforms For Options

-

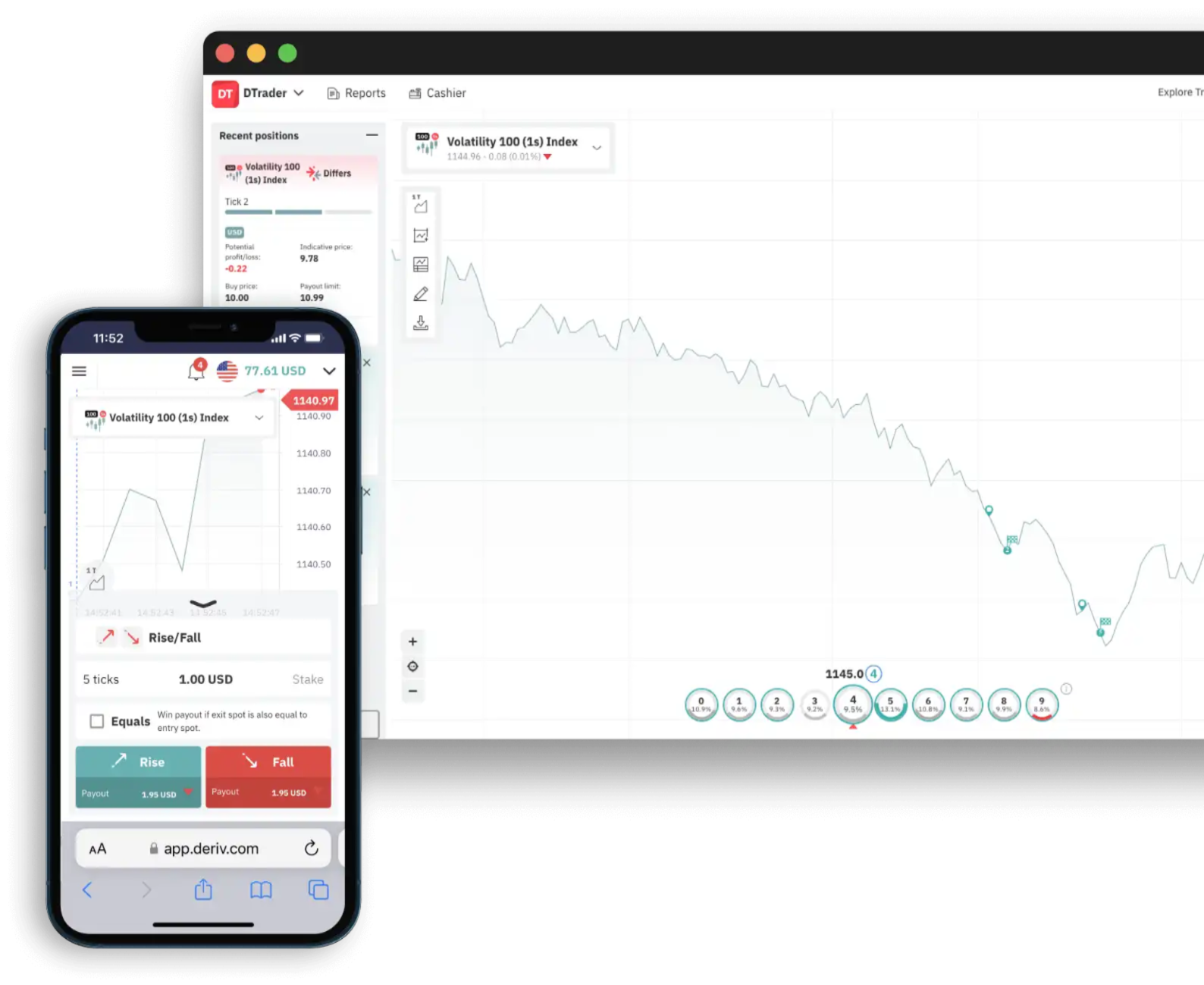

Deriv Trader (DTrader): This is a web-based options trading platform that offers a high level of customization in charts, technical indicators, and trade types, with stakes as low as $0.35 and durations as short as a second.

-

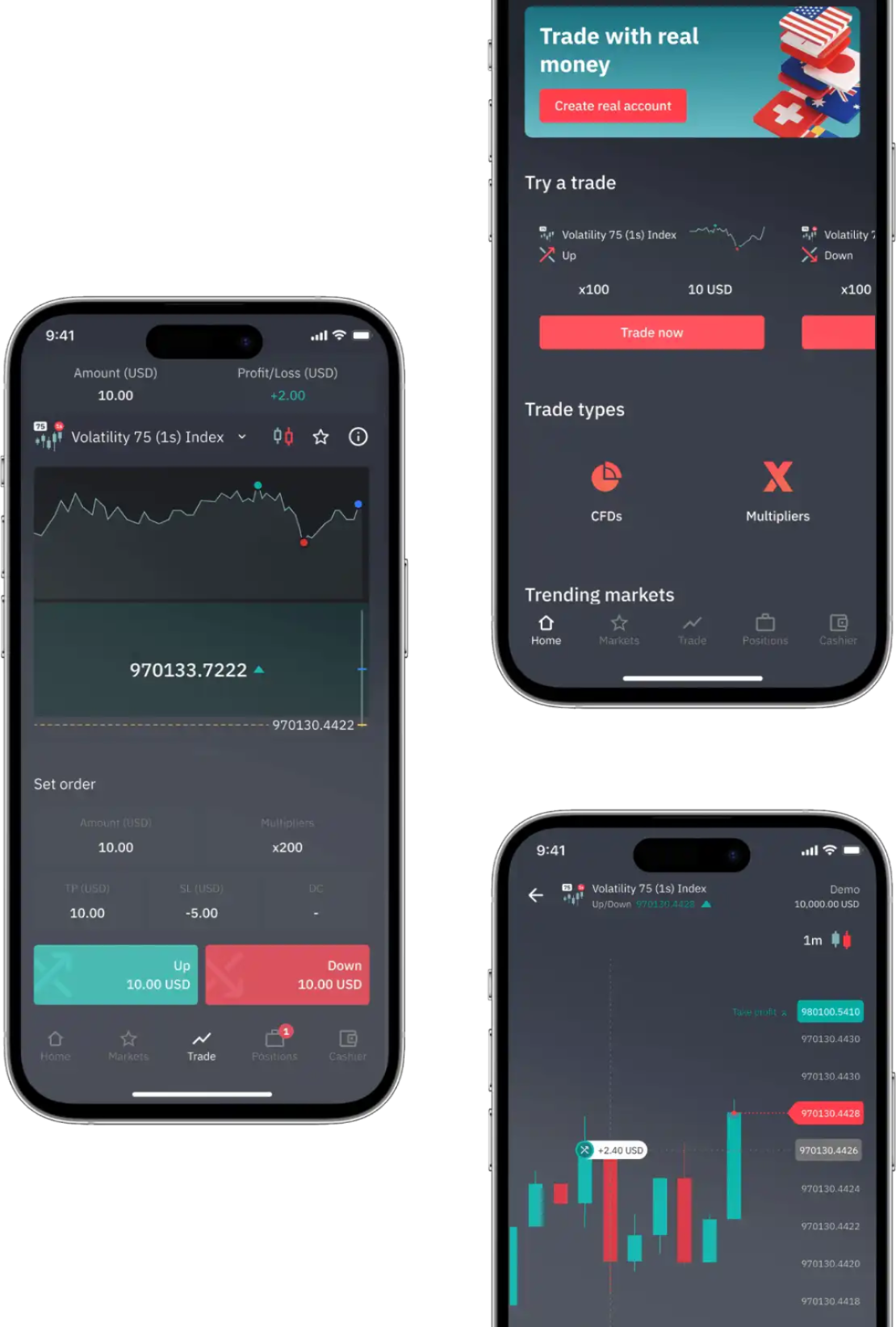

Deriv GO: This is a mobile app designed for convenient trading of multipliers anytime, anywhere. With this app, you can trade multipliers on forex, ETFs, derived indices, and cryptocurrencies. It allows you to maximize your potential profits while ensuring that you only risk the amount you have invested.

-

SmartTrader: This is a powerful, user-friendly online trading platform that allows you to trade digital options on the world's markets. It is a web-based platform, so you can access it from any device with an internet connection.

-

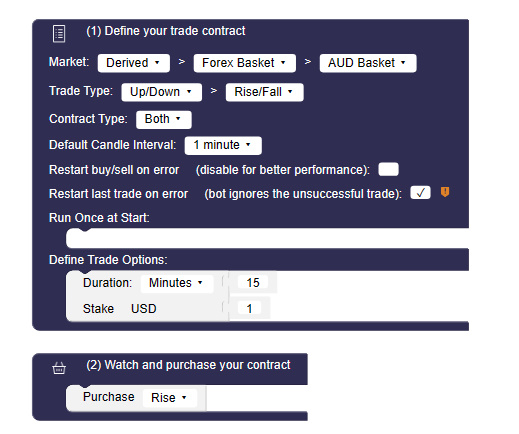

Deriv Bot (DBot): This is a drag-and-drop trading robot development tool offered by Deriv, enabling you to automate your trading activities on their platform. It is a user-friendly platform suitable for both beginners and experienced traders. With Dbot, you have the flexibility to create, adjust, and enhance multiple trading bots. Whether you prefer simple formulas or more advanced algorithms, you can customize your trading strategies to meet your specific needs.

-

Binary Bot: This is an older classic drag-and-drop trading robot development tool also offered by Deriv for easy trading robot development similar to Deriv's DBot.

Deriv's Trading Platforms For CFDs

-

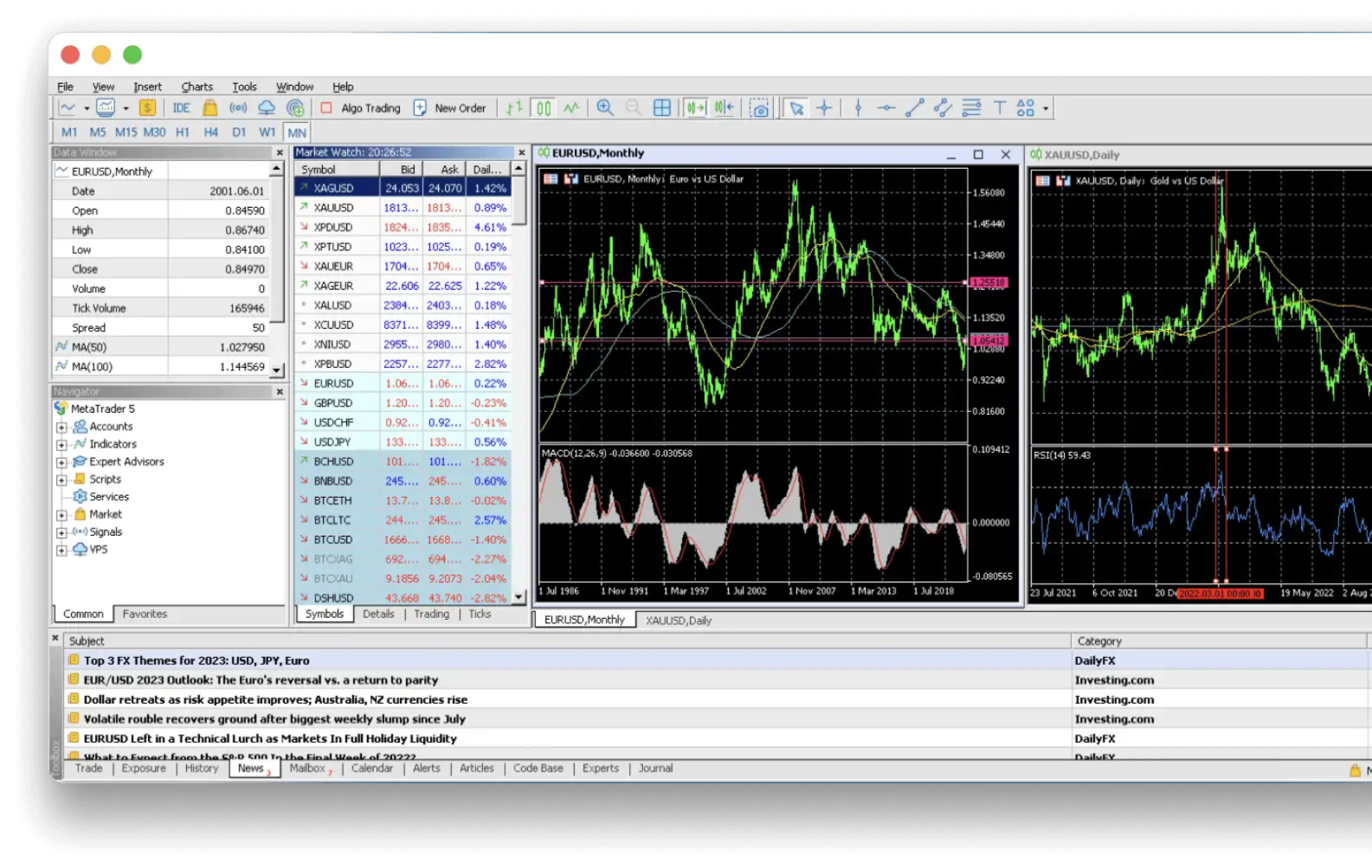

Deriv MT5: Gain access to a wide range of asset classes, including forex, ETFs, stocks, indices, cryptocurrencies, commodities, exchange-traded funds, and derivatives, all on a single platform. With MT5, you can enjoy the benefits of automated trading with expert advisors and copy trading using trade signals.

-

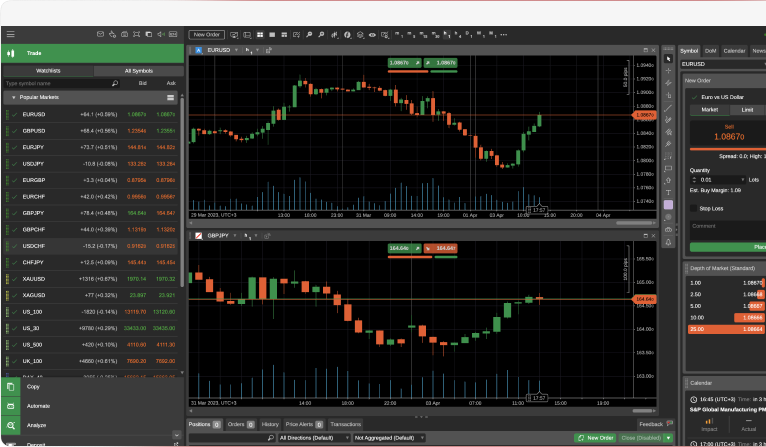

Deriv cTrader: Gain access to a multi-asset CFD trading platform packed with a wide range of features on a user-friendly interface. Enhance your trading experience further with features such as limit order and stop order, chart trading, and custom indicators.

-

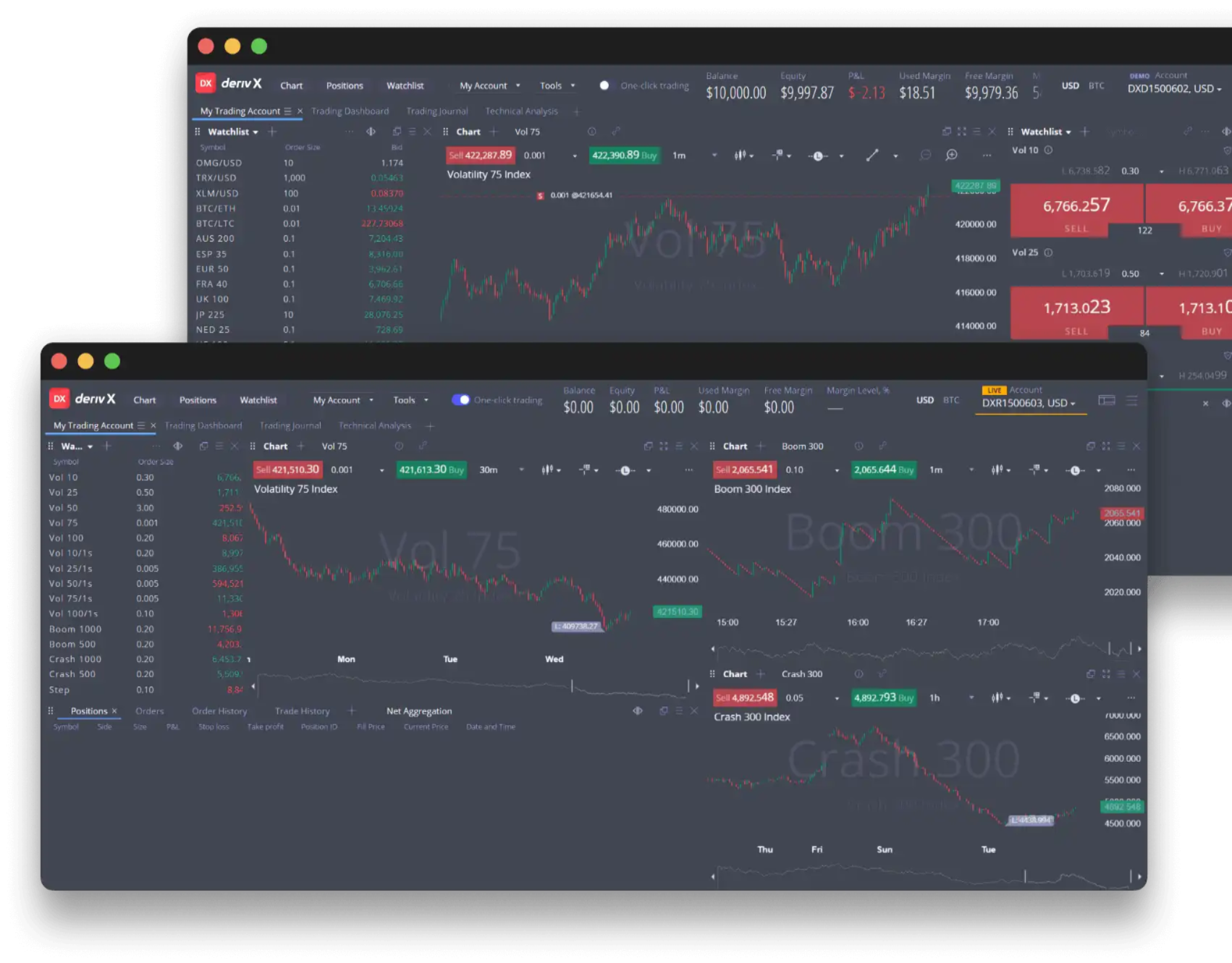

Deriv X: This is a flexible trading platform that you can personalize according to your preferences. It allows you to trade CFDs on various assets such as forex, ETFs, commodities, exchange-traded funds, stocks, indices, cryptocurrencies, and derived products. With Deriv X, you have the freedom to create a customized trading environment that suits your needs and preferences.

-

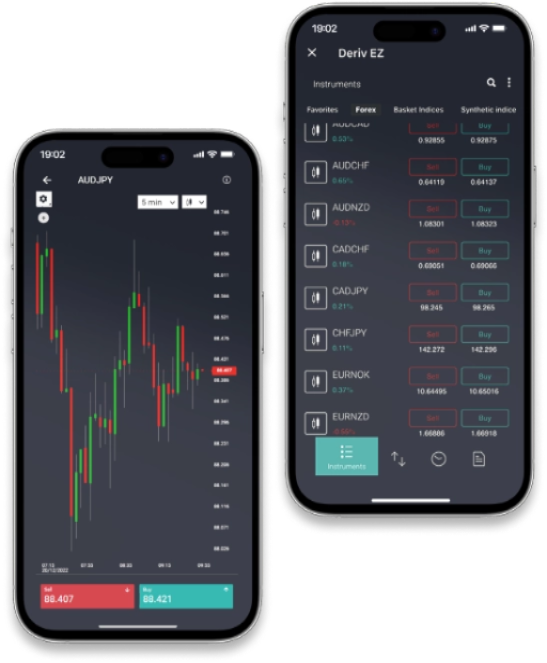

Deriv EZ: This is a user-friendly mobile trading platform that offers instant access to all your favorite assets. Trade CFDs on Deriv EZ and access a wide variety of assets in forex, ETFs, stocks and indices, commodities, cryptocurrencies, and derived indices.

Below is a table of the features that are available on each platform:

| Platform | OS | Trade Types |

|---|---|---|

| Deriv Trader | Web App | Options, Multipliers |

| Deriv GO | Web App | CFDs, Multipliers |

| SmartTrader | Web App | Options |

| Deriv Bot | Web App | Options |

| Binary Bot | Web App | Options |

| MT5 | Web App, Windows, Linux, macOS, Android, iOS | CFDs |

| cTrader | Web App, Windows, Linux, macOS, Android, iOS | CFDs |

| Deriv X | Web App | CFDs |

| Deriv EZ | Web App | CFDs |

What Trading Fees and Commissions Does Deriv Charge?

Deriv offers options trading without any fees or commissions. However, when it comes to trading CFDs and multipliers, there are some fees and commissions to be aware of. Here are the main ones:

- Options: No fees or commissions for options trading are charged. Zero fees and commissions.

- CFDs Spread: The spread is the difference between the buy and sell price of an asset. Deriv charges a spread on all CFD trades, and the size of the spread will vary depending on the asset you are trading.

- CFDs Swap: A swap is a fee that is charged when you hold a position overnight. Deriv charges a swap on some types of trades, such as CFDs. The swap will vary depending on the asset you are trading and the direction of your trade.

- Inactivity fee: If your account remains inactive for a certain period, Deriv may charge an inactivity fee. The specific amount depends on the type of account you have, but it is usually around $25.

In addition to these fees, Deriv may also charge other fees, such as fees for withdrawals and deposits.

Note: To access a full list of spreads on CFD-tradable assets like forex and other assets, as well as detailed information about fees and commissions, click on the following link to visit Deriv's website.

Which Deposit and Withdrawal Methods Does Deriv Accept?

Deriv offers a range of deposit and withdrawal methods, including:

- Credit and debit cards: You can use Visa, Mastercard, and Maestro cards.

- Bank transfers: Deriv supports bank transfers in different currencies.

- eWallets: Options like Skrill, Neteller, and Perfect Money are available.

- Cryptocurrencies: Deriv accepts popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

- Authorised payment agents: Deriv teams up with local payment agents to handle deposits and withdrawals for Deriv customers.

- Deriv P2P: Deriv's peer-to-peer service simplifies deposit and withdrawal, allowing you to connect with fellow traders and swiftly transfer funds in your local currency.

Below is a table of some of the deposit and withdrawal methods Deriv supports:

| Method | Currencies | Min-max deposit | Min-max withdrawal | Deposit processing time | Withdrawal processing time |

|---|---|---|---|---|---|

| Credit and debit cards | |||||

| Visa, Visa Electron, Mastercard, Maestro, Diners and JCB | USD, EUR, AUD, GBP | $10 - $10,000 | $10 - $10,000 | Instant | 1 business day |

| E-wallets | |||||

| Fasapay, PerfectMoney, Skrill, Neteller, Webmoney, PaysafeCard, Jeton and Sticpay | USD, EUR, AUD, GBP | $5 - $10,000 | $5 - $10,000 | Instant | 1 business day |

| Online banking | |||||

| Instant bank transfer, PaysafeCard, Help2Pay, Dragon Phoenix, ZingPay and NganLuong | USD, EUR, AUD, GBP | $5 - $50,000 | $5 - $50,000 | Instant to 1 business day | 1 - 3 business days |

| Cryptocurrencies | |||||

| Bitcoin, Ethereum, Litecoin, USDCoin and Tether | BTC, ETH, LTC, USDC, USDT | No minimum | 0.0003 | Instant | Subject to internal checks |

| Fiat onramp - Buy crypto on popular exchanges | |||||

| Changelly, Banxa and Xanpool | USD, EUR, AUD, GBP, BTC | $50 - $5,000 | - | 5 - 30 minutes | - |

Note: Please be aware that Deriv continuously introduces new deposit and withdrawal options. For more comprehensive and up-to-date information, kindly refer to their website at the following link.

Who Regulates Deriv?

Deriv operates under the supervision of various regulatory bodies, which include:

Regulatory Entities

- The Malta Financial Services Authority (MFSA)

- The Labuan Financial Services Authority (Labuan FSA)

- The Vanuatu Financial Services Commission (VFSC)

The MFSA oversees financial services providers in Malta, while the Labuan FSA supervises entities in Labuan, Malaysia, and the VFSC regulates operations in Vanuatu.

Memberships

- International Financial Services Commission (IFSC)

- Financial Conduct Authority (FCA)

The IFSC, headquartered in Belize, is responsible for overseeing financial services providers in Belize, while the FCA, based in the United Kingdom, supervises providers in the UK.

Being regulated by these entities ensures that Deriv adheres to stringent customer protection measures, including financial stability, anti-money laundering practices, and customer safeguards.

Industry Associations

- Financial Markets Association (FMA)

- International Swaps and Derivatives Association (ISDA)

Moreover, Deriv holds memberships in esteemed industry associations like the FMA and ISDA. These affiliations underscore Deriv's dedication to upholding industry best practices in the financial services sector.

What Are Some Alternative Brokers To Deriv?

If Deriv is not supported in your country, here are some other brokers that offer similar services to Deriv:

Verdict and Key Takeaways on Deriv Broker

Why Should I Trade With Deriv?

If you're wondering why you should choose Deriv as your trading platform, here are some compelling reasons:

- Trust and Regulation: Deriv is a regulated broker, providing you with the assurance that your funds are secure, and the company adheres to strict financial standards.

- Proven Track Record: With over 22 years of experience, Deriv is the oldest options broker, known for its reliability and long-standing presence in the industry.

- Wide Range of Tradable Products: Deriv offers an extensive selection of financial products, including CFDs, multipliers, various types of digital options, binary options, and vanilla options. This diverse range allows you to find the perfect fit for your trading style and risk tolerance.

- Multiple Trading Platforms: Choose from a variety of trading platforms, including the highly popular MT5, to suit your preferences and needs.

- Trade Automation: Deriv stands out as the only digital and binary options broker that fully supports option trading automation, enabling you to streamline and automate your trading strategies.

- Responsive Customer Support: Deriv's customer support is available 24/7, ensuring that your inquiries and concerns are promptly addressed.

- Accessible Trading: Deriv allows you to start trading with a minimum trade balance of as low as $10 and a minimum trade size of as low as $0.35, making it accessible for traders of different budgets.

- Flexible Trading Hours: Enjoy the convenience of 24/7 trading with Deriv, even during weekends, ensuring you can engage in trading at any time that suits you.

- Synthetic Indices and Stable Spreads: Deriv offers synthetic indices that safeguard against market gaps, along with stable fixed spreads that do not widen during periods of volatility.

- Free demo account: Deriv offers a free demo account that you can use to try out the platform and its features before you start trading with real money.

Final Verdict About Deriv

In my honest opinion, Deriv stands out as the ultimate options broker, catering to both beginner and experienced traders, regardless of their account size. My strong recommendation is to seize the opportunity and open a Deriv account without any hesitation. Why look elsewhere when you have access to all the essential tools required to embark on a profitable journey in the options or CFD market? With Deriv, you can rely on a tried and tested broker that guarantees reliability and long-term commitment. Take the next step and unlock your potential for financial success with Deriv today.

Note: Deriv offers a free demo account for you to test their services and see if it meets your needs. Open your free Deriv account now and take their trading platforms for a spin. Discover the perfect fit for your trading journey! Don't just take my word for it - try it out yourself!

Start Trading With Deriv Today

Open your free Deriv account and turn your trading goals into profits!

Open A Deriv Account